Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Pacific Premier Trust, a subsidiary of Pacific Premier Bank, is a reliable option for individuals seeking retirement and savings accounts. The organization offers a diverse range of account options to cater to the specific needs of both new and existing clients.

For Individual Retirement Accounts (IRAs), Pacific Premier Trust has extensive experience managing various types, including self-directed, traditional, Roth, inherited and custodial IRAs. This comprehensive review ensures clients can select the IRA type that aligns with their retirement goals and investment preferences.

Additionally, the organization is well-versed in handling small business retirement accounts like simple and SEP IRAs, catering to the needs of entrepreneurs and business owners.

One of the notable strengths of Pacific Premier Trust lies in its comprehensive custodial services. They handle crucial aspects such as account applications and activation, financial transaction processing, record-keeping and reporting for the Internal Revenue Service (IRS).

This approach ensures that clients receive comprehensive support in managing their retirement accounts, simplifying the administrative processes and ensuring compliance with tax regulations.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

About Pacific Premier Trust

Pacific Premier Trust Company, formerly PENSCO Trust, has a long-standing history since December 1989. In 2020, the company merged with Pacific Premier Bank and adopted the bank's name.

With its headquarters in Irvine, California, Pacific Premier Trust operates physical branch locations in Irvine, San Francisco, California and Denver, Colorado, providing accessibility and convenience to its clients.

As a custodian, Pacific Premier Trust currently oversees an impressive $17.6 billion in assets under custody, evidencing its substantial presence in the industry. With a client base of 43,903 accounts, the company serves a diverse range of individuals seeking retirement and investment solutions.

One notable aspect of Pacific Premier Trust is its wide range of available assets for investment. It boasts one of the most extensive selections of alternative investments in the United States, offering clients diverse options to meet their investment objectives.

The company takes pride in its custody of approximately 40,345 unique assets, showcasing its commitment to providing clients with a comprehensive range of investment opportunities.

Pacific Premier Trust offers expertise in self-directed and traditional retirement accounts as a financial organization directly associated with a bank.

Its knowledgeable representatives guide potential account holders through the differences between various account types and assist them in making informed decisions regarding alternative and common investments.

This personalized approach helps clients understand their options and navigate the complexities of retirement planning.

While Pacific Premier Trust's minimum fees may be higher than average, the company's broad range of available assets and expertise in alternative investing make it an attractive choice for individuals seeking diverse investment opportunities within their retirement accounts.

Company Management

Pacific Premier Trust maintains privacy regarding its top management team and there is limited publicly available information on the individuals leading the company. However, there are a few key figures mentioned on their website:

Tamara Wendoll (COO)

Tamara Wendoll brings nearly 25 years of experience in the investment industry. She joined Pacific Premier Trust in November 2021, assuming the role of Chief Operating Officer. Before joining Pacific Premier Trust, Wendoll served as the COO of Durham Trust Company for nine years, where she gained valuable expertise in the trust and custodial services industry.

William Eustis (Head of Sales)

William Eustis joined Pacific Premier Trust in October 2020, leading the company's sales division. With over 15 years of experience in the investment industry, Eustis has held significant roles in prominent financial institutions. He spent eight years as Executive Vice President at Cannon Financial Institute, specializing in wealth management and retirement services. Before that, he had a 6-year tenure at Bank of America.

It's worth noting that the available information may not provide a comprehensive view of the entire management team at Pacific Premier Trust. The company's Crunchbase profile suggests a staff size between 51 and 100 employees, while their LinkedIn profile showcases 113 employees with associated profiles.

These numbers indicate the presence of a dedicated team working behind the scenes to support the company's operations and serve its clients.

Clients Served by the Company

Pacific Premier Trust serves diverse clients, catering to their needs and investment objectives. Here's a closer look at the clients they work with:

❑ Family Offices

Family offices, private management firms established by high-net-worth families, can benefit from Pacific Premier Trust's services. The company assists family offices in leveraging the tax advantages associated with using retirement savings to invest in alternative assets.

Family offices can optimize investment strategies and maximize returns by utilizing self-directed IRAs.

❑ Individuals

Pacific Premier Trust's primary focus is on individual investors. They offer IRA solutions that empower clients to pursue investment strategies and achieve retirement savings goals.

With tax-advantaged IRA accounts, individuals have the flexibility to invest in a wide range of alternative assets while enjoying the potential tax benefits associated with retirement accounts.

❑ Professional Service Providers

Pacific Premier Trust collaborates with professional service providers such as Certified Public Accountants (CPAs), lawyers and real estate agents. These professionals often advise clients on investing in alternative assets using IRA funds.

Pacific Premier Trust helps enhance the knowledge and understanding of self-directed IRAs among professional service providers, enabling them to guide their clients in navigating the complexities of alternative investments.

❑ Broker-Dealers and Registered Investment Advisors

Pacific Premier Trust is a trusted custodian for broker-dealers and registered investment advisors. As an independent and regulated custodian, they have a wealth of experience in alternative asset custody spanning over three decades.

They provide comprehensive support to these professionals, offering quarterly statements that overview account positions and transaction activity.

Additionally, a dedicated Relationship Manager is available to ensure transparent and efficient communication, meeting the expectations of broker-dealers and registered investment advisors.

Pacific Premier Trust IRA Accounts

Pacific Premier Trust offers a comprehensive range of IRA accounts to cater to the diverse needs of investors.

▢ Traditional IRA

Traditional IRAs provide flexibility and have no minimum contribution requirements or income restrictions. Contributions to a Traditional IRA are tax-deductible, helping to reduce current taxable income.

This type of IRA is suitable for individuals who want to defer taxes until they withdraw the funds penalty-free after reaching 59 ½ years of age. Minimum withdrawals are required once the account holder turns 72.

▢ Roth IRA

Roth IRAs allow account holders to make contributions with after-tax income. This type of retirement account is ideal for individuals who anticipate being in a higher tax bracket during retirement.

Qualified withdrawals from a Roth IRA can be made tax-free and penalty-free after reaching the age of 59 ½. Roth IRAs have no required minimum distributions or age limits for making contributions, offering greater flexibility.

▢ Inherited or Beneficiary IRA

Individuals receive inherited or beneficiary IRAs after the original account holder passes away. The new owner must reopen the account as a new Traditional or Roth IRA.

Contributions cannot be made to the inherited account and taxes and penalties may apply. Beneficiaries can include spouses, relatives, non-relatives or charitable organizations.

▢ Custodial IRA

A Custodial IRA allows parents or guardians to save for a child under 18. It can be a Traditional or Roth IRA, opened in the child's name.

The child can contribute if they have a source of income and family members can contribute as long as the total contributions do not exceed the child's income.

▢ Business Retirement Accounts

Pacific Premier Trust offers two types of business IRAs. SEP IRAs (Simplified Employee Pension IRAs) allow employers to fund employee retirement accounts, including sole proprietors, corporations and partnerships.

Employees can manage the investments within the SEP IRA's trustee-set limits. SIMPLE IRAs (Savings Incentive Match Plan for Employees) are suitable for small firms with fewer than 100 employees.

Employers can make contributions to their employees' accounts, which are tax-deductible. SIMPLE IRAs have low setup and maintenance costs, making them an attractive option for small businesses.

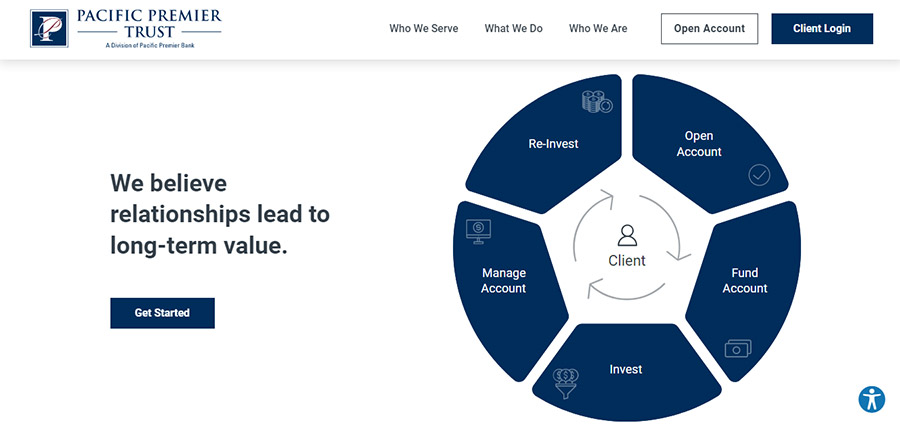

Opening an Account with Pacific Premier Trust

Opening an account with Pacific Premier Trust is a straightforward process that can be initiated by following a few steps:

Investment Options at Pacific Premier Trust

Pacific Premier Trust offers self-directed IRA accounts that allow clients to diversify their retirement portfolios beyond traditional stocks and bonds. Clients can explore alternative investment options with a self-directed IRA from Pacific Premier Trust.

❏ Private Equity

Clients can invest in private equity assets, including owning a stake in non-publicly traded businesses. These investments can be in active companies, real estate projects or investment partnerships, offering potential tax advantages and opportunities for growth.

❏ Real Estate

Clients can invest in real estate directly or indirectly through their self-directed IRAs. They can choose to invest in residential properties, commercial properties or even raw land. Real estate investments can provide long-term appreciation, rental income or opportunities for quick flips.

❏ Promissory Notes

Clients can use their self-directed IRA funds to invest in promissory notes, such as trust deeds and mortgages. Investing in promissory notes can offer the potential for positive cash flow and attractive interest rates. Keeping debt obligations within an IRA may also provide favorable tax treatment.

❏ Alternative Assets

Pacific Premier Trust allows clients to diversify their portfolios in alternative asset classes. This includes precious metals like gold, silver, platinum or palladium, subject to IRS and operational requirements.

Clients can also explore investments in land, mineral rights, wind farms, peer-to-peer lending and other approved assets.

❏ Stock Market Securities

Clients can conveniently invest in a wide range of stock market securities through Pacific Premier Trust's online trading platform. This includes thousands of mutual funds, bonds, stocks, CDs, ETFs and annuities, eliminating the need for a separate custodian for stock market investments.

Fees Information

Pacific Premier Trust has a fee structure in place that covers various aspects. Here is a breakdown of the fees associated with the company IRA accounts:

Final Thoughts

With its extensive experience and expertise in retirement account custodianship, Pacific Premier Trust offers a range of options for individual and business investors.

While the minimum asset requirements and various fees may make it more suitable for seasoned individual investors, it is an excellent choice for business owners looking to enhance retirement funds for their employees while enjoying tax benefits.

Client feedback indicates satisfaction with Pacific Premier Trust's user-friendly approach to opening and managing retirement accounts. The company's well-designed website enhances the client experience, providing easy navigation and clear information.

The team at Pacific Premier Trust demonstrates professionalism and expertise in the field, helping investors work towards their retirement goals effectively. With a strong reputation and commitment to the security and growth of clients' retirement funds, Pacific Premier Trust is a trusted custodian in the industry.

Overall, Pacific Premier Trust presents a reliable and reputable option for individuals and businesses seeking a custodian for their retirement accounts. It offers comprehensive services and support to help investors achieve their long-term financial objectives.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<