Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Investing in gold is a popular way to diversify one's portfolio and protect against market volatility. However, choosing a suitable gold IRA company can be overwhelming due to the numerous options available.

This article narrows down the top five gold IRA providers based on customer service, years in business and competitive pricing. These companies offer valuable resources, market data and support services to help beginners and experienced investors make informed decisions.

Best Gold IRA Companies

#1st Rated

#2nd Rated

#3rd Rated

#4th Rated

#5th Rated

1. Goldco

About Goldco

Goldco, a Los Angeles-based privately held firm with over a decade of experience, has been dedicated to helping clients ensure the security of their retirement savings.

They specialize in guiding individuals through purchasing gold and silver or diversifying their retirement assets into a Precious Metals IRA.

One of the critical reasons why Goldco stands out as the go-to precious metals provider is its long-standing history of delivering superior customer service. Their commitment to high ethical standards has earned them a stellar reputation among their clientele.

Moreover, it offers extensive educational materials to empower its customers with relevant knowledge about precious metals investments.

If you possess a tax-deferred retirement account such as an IRA, 401(k), 403(b) or Thrift Savings Plan (TSP), its experts are well-equipped to assist you in setting up a precious metals IRA. Doing so can safeguard your savings by diversifying into precious metals' stability and potential growth.

Goldco lets customers buy gold and silver directly from their platform, eliminating unnecessary intermediaries. Their team of dedicated specialists is available to provide personalized advice on diversifying your savings by purchasing precious metals.

Whether you prefer to buy gold and silver directly or rollover your retirement savings into a precious metals IRA, the experts will guide you through every step of the process, ensuring a seamless experience.

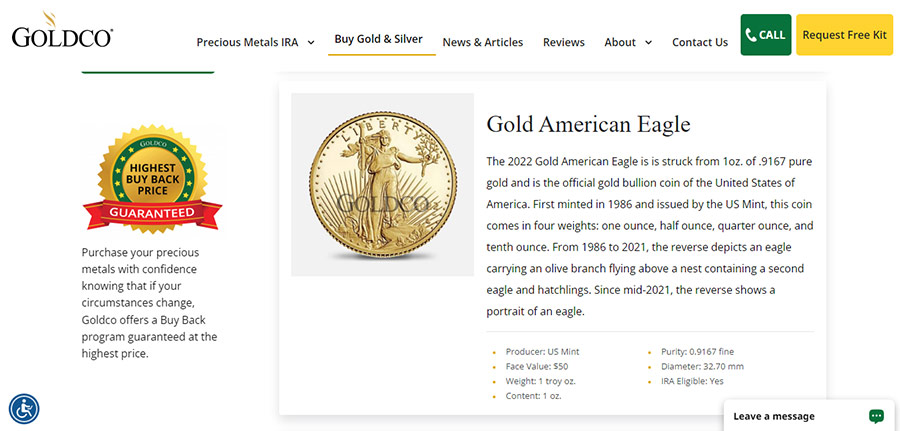

Product Offered by Goldco

Goldco, a trusted leader in the precious metals industry, has built a strong reputation for over a decade by helping customers protect and secure their retirement savings. Their expertise extends to various tax-advantaged retirement accounts, including IRAs, 401(k)s, 403(b)s, TSPs and similar accounts.

If you possess any of these accounts, the firm is well-equipped to assist you in setting up a precious metals IRA, allowing you to safeguard your assets with the stability and potential growth of precious metals.

In addition to its comprehensive IRA services, it offers direct sales of gold and silver to its valued customers. Whether you're interested in rolling over your retirement assets into a Precious Metals IRA or purchasing gold and silver directly, the knowledgeable specialists will guide you.

When you engage with the company, you can expect a seamless and hassle-free experience from start to finish. Their specialists are committed to exceptional customer service and meeting your needs and goals.

From the initial consultation, where they will assess your unique situation and requirements, to the final transaction, they will be by your side, offering guidance and support at every step.

Whether you diversify your retirement portfolio through a Precious Metals IRA or directly purchase gold and silver, Goldco focuses on providing a personalized and reliable experience.

With their extensive knowledge and expertise in the industry, they can offer valuable insights and recommendations tailored to your specific financial goals and circumstances.

Required Minimum Investment and IRA Fees

To initiate a gold IRA with Goldco, a minimum purchase of $25,000 is required. Goldco's preferred Custodian applies a flat annual account service fee encompassing several components. This fee incorporates a one-time IRA account set-up fee of $50 and a $30 wire fee. Additionally, there is an annual maintenance fee of $100.

For the storage of precious metals in your gold IRA, Goldco offers two options: segregated storage and non-segregated storage. The fee for segregated storage is $150 per year, while non-segregated storage costs $100.

It's important to note that fees associated with gold storage and custodianship can vary depending on the service provider you choose, as all IRA assets must be managed by a custodian as mandated by the IRS. Depending on the specific Custodian, storage fees can range from $10 to $60 per month or as a percentage of assets, typically falling between 0.35% and 1% annually.

Goldco does not impose storage fees for cash transactions exceeding $25,000, providing added flexibility for investors.

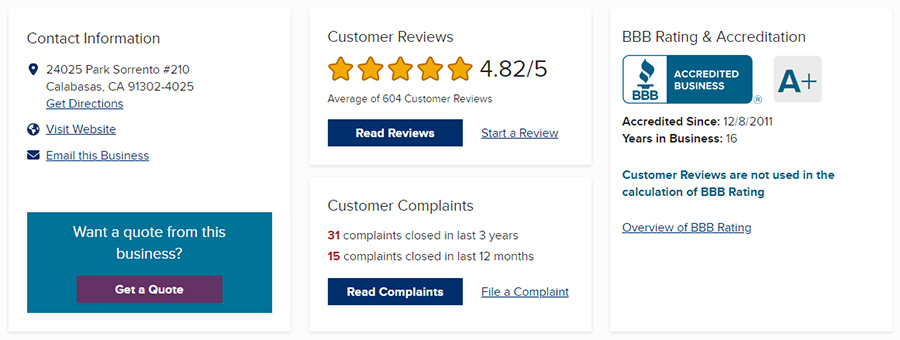

Goldco Ratings, Reputation and Customer Reviews

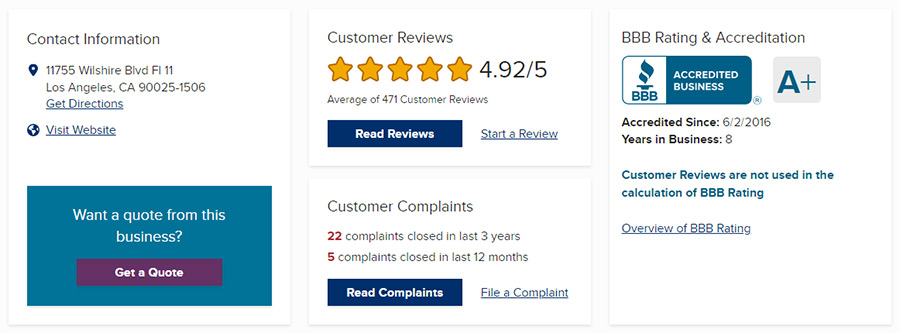

Goldco has cultivated a strong reputation among its customers and industry watchdog organizations, positioning itself as a trusted and reliable company in the precious metals industry. Notably, the company has received an impressive A+ rating from the Better Business Bureau (BBB).

This rating signifies the firm's commitment to maintaining ethical and transparent business practices, reinforcing its reputation as a company that operates with integrity.

Regarding customer reviews and satisfaction, it has consistently received high praise from its clientele. With an excellent rating of 4.89 out of 5, it's clear that customers have had overwhelmingly positive experiences with the services.

Goldco's ability to consistently deliver on its promises and exceed customer expectations has earned them high trust and satisfaction within the industry. Customers value its professionalism, reliability and expertise in guiding individuals through protecting their retirement savings with precious metals.

Pros and Cons of Goldco

Pros

Cons

About Augusta Precious Metals

Augusta Precious Metals has established itself as a reputable provider with a strong focus on client satisfaction and industry expertise. They have garnered recognition from professionals in the field and enjoy an excellent reputation within the market.

Founded in 2012 and headquartered in Beverly Hills, California, this firm is an acclaimed gold and silver IRA company with numerous awards for its exceptional services.

What sets the company apart from many other gold IRA companies is its unique approach to simplifying economics and educating individuals on diversifying their investment portfolios to support their retirements.

It is renowned for its silver and gold pension investments, widely regarded as some of the best in the industry. By offering diversified investment options, Augusta enables clients to protect and grow their wealth across multiple areas, ensuring a more secure retirement.

When you choose it as your gold IRA provider, you can expect exceptional service throughout your customer journey. Their experienced staff can readily address your inquiries and provide comprehensive information about your retirement accounts. Whether you have concerns or need clarification, its dedicated team is committed to meeting your needs.

One notable aspect of this firm is its commitment to honesty and customer satisfaction. They offer a money-back guarantee, ensuring clients are delighted with their services. This guarantee provides peace of mind for gold IRA investors, including first-time gold IRA owners, as it allows them to explore gold investments with reduced risk through price protection policies.

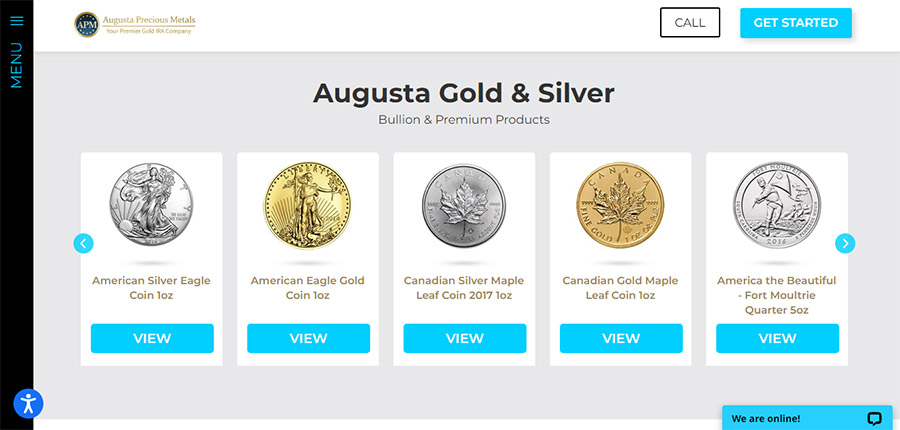

Augusta Precious Metals Services

Augusta Precious Metals offers services for individuals seeking to hedge against inflation or diversify their holdings through precious metals IRAs.

To open an account, potential buyers are required to have a minimum of $50,000 in a qualified retirement plan, such as a 401(k) or traditional IRA, ensuring a solid foundation for their precious metals investments.

Recognizing that a gold IRA operates differently from a traditional IRA, it has developed a streamlined onboarding process to simplify the purchase of precious metals. This approach aims to make it easier for customers to navigate the unique aspects of a gold IRA and acquire the desired precious metals for their investment portfolio.

By providing various precious metals IRA choices, the firm enables individuals to tailor their investments to their specific goals and preferences. Whether gold, silver or other precious metals, clients can diversify their holdings and protect their wealth against economic uncertainties.

The firm's expertise in precious metals IRAs ensures clients receive professional guidance and support throughout the investment process. Their knowledgeable team is equipped to address client inquiries, offer insights into market trends and provide comprehensive information to help individuals make informed decisions.

Storage

The company has gone to great lengths to ensure the security and storage of its client's precious metals. Through extensive research and evaluation, it has identified the Delaware Depository as the optimal U.S.-secured private depository to partner with.

This recognized institution has met Augusta's rigorous standards and provides a secure storage solution for its clients' precious metals.

Delaware is the company's preferred location for storage facilities and unless clients have specific preferences, Augusta recommends utilizing the Delaware Depository.

However, it understands that individual preferences may vary and they offer multiple depository options across different states to cater to their clients' needs.

When entrusting Augusta with their precious metals, clients can rest assured that their assets are stored in a private, non-bank vault. These vaults meet or exceed all federal security standards, ensuring the highest level of protection for the stored metals.

Notably, the assets are kept separate from the depository's creditors and are shielded from potential financial and political centers. The storage process is legally documented, providing clients with transparency and peace of mind.

IRA Fees

Augusta Precious Metals distinguishes itself from many other gold IRA companies by not charging management fees. This is a notable advantage for clients seeking to maximize their investment returns. However, there are three specific fees associated with its services, which are as follows:

❑ Setting Up Fees: When establishing an IRA with this firm, new customers are required to pay a one-time set-up fee of $50. Additionally, two annual fees of $100 each are due at the signing of the account. Consequently, the total cost of setting up an account amounts to $250.

❑ Annual Fees: It charges yearly fees for custodian and storage services. The custodian and storage fees are $100, resulting in a total annual fee of $200. These fees contribute to the maintenance and secure storage of the precious metals within the IRA.

❑ Spread: The company applies a spread to the purchase and sale prices of precious metals. Their spread, representing the difference between the buying and selling prices, is set at 5%. This spread is relatively low compared to many other precious metal IRA companies. However, it's important to note that for premium purchases, the spread can increase up to 33%.

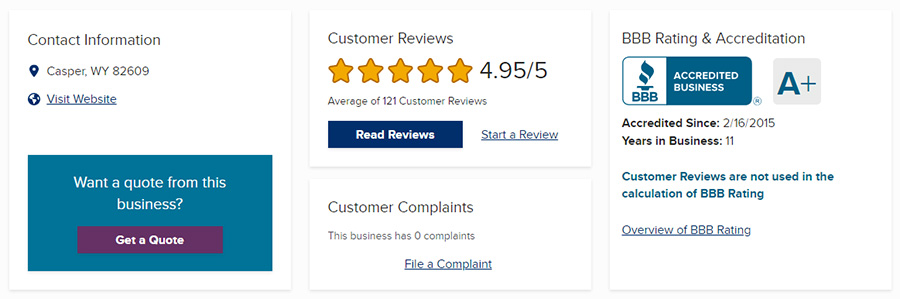

Reviews and Ratings

As part of our thorough review of this firm, we examined reputable review sites to gather insights from clients regarding their experiences with the company. The results reaffirm its outstanding reputation and commitment to customer satisfaction.

The BBB, a trusted organization providing ratings and customer feedback, awarded Augusta Precious Metals an A+ rating. On the BBB website, we found a remarkable 120 customer reviews, all of which were highly positive, resulting in an average rating of 4.97 out of 5.

Notably, no complaints were registered against the firm—an exceptional achievement within the financial sector.

Consumer Affairs, a powerful platform for customer reviews and news, also showcased it positively. With 131 positive reviews and an average rating of 4.9 out of 5, it is evident that clients have had highly satisfactory experiences with the company.

Further validation of Augusta's excellent reputation can be found on Google, where over 320 customer reviews have contributed to an impressive average rating of 4.9 out of 5. On Facebook, it has amassed more than 120 reviews related explicitly to Augusta gold IRA, with an average rating of 4.8 out of 5.

The positive sentiment extends to Trustlink, a platform known for its trusted customer reviews. Augusta Precious Metals has received over 280 reviews on Trustlink, with an impressive average rating of 4.9 out of 5.

Across various online platforms, clients consistently express their satisfaction with the company, highlighting its exceptional service and ability to provide a stress-free experience. The A+ BBB and AAA BCA ratings further solidify Augusta's standing as one of the top choices when considering gold IRA companies for retirement account investments.

Pros and Cons of Augusta Precious Metals

PROS

Cons

About American Hartford Gold

American Hartford Gold stands out for its exceptional service quality and customer satisfaction. The company takes pride in its highly professional and attentive staff, as evidenced by numerous positive customer reviews.

Clients appreciate the prompt responsiveness and the knowledgeable assistance provided by the team at American Hartford Gold.

One important advantage is the company's accessibility. With their hotline available nearly round the clock, customers can easily contact the firm for any inquiries or concerns.

This commitment to maintaining open lines of communication ensures that clients can conduct business with the company conveniently, regardless of their location or the time they reach out.

Product Offerings

It offers a comprehensive range of products and services to meet the diverse investment needs of its clients. As a metals and storage IRA provider, they provide access to financial advisors, ensuring that investors can make informed decisions about their precious metal investments.

Clients have the option to invest in gold and silver through a traditional IRA, as well as purchase coins and bars directly. American Hartford Gold offers a variety of coins, including popular options such as the American Eagle, Australian Wildlife, Canada Buffalo and South African Krugerrand.

They also provide a 1-ounce gold bar and a gold or silver Valcambi CombiBar. While platinum alternatives are more limited, options are still available.

To assist clients in making informed investment choices, each coin or bar has a detailed data page providing important information such as the manufacturer, weight, purity, dimensions and IRA eligibility. This transparency allows investors to assess the suitability of the products for their retirement accounts.

One standout feature of this firm is its Buyback Promise, which offers flexibility and freedom to investors. Clients are not obligated to return their metals to the company and can choose to liquidate their investments with any reputable precious metal dealer.

The liquidation process is straightforward, involving three simple steps without incurring additional costs.

Moreover, it allows real-time discussions with industry professionals, allowing investors to seek expert investment guidance. They also offer assistance in opening a gold IRA, ensuring a seamless experience for clients without any extra charges.

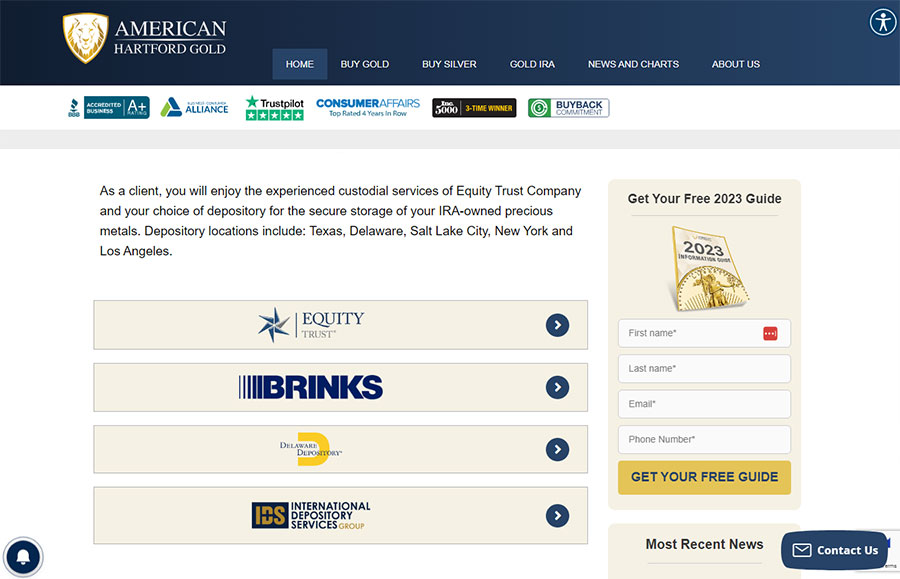

Storage Options

American Hartford Gold prioritizes the security and safekeeping of clients' physical precious metals holdings. They have partnered with renowned institutions such as Brinks Global Services, Delaware Depository Service Company (DDSC) and International Depository Services (IDS) to provide secure storage solutions.

These depositories are well-established and operate from highly secure locations, ensuring the protection of clients' assets. They maintain multibillion-dollar insurance policies to safeguard client funds further. With multiple warehouses across the United States, transporting metals to and from the depository is efficient and convenient.

Costs and Fees

Clients can expect to encounter costs and fees associated with standard IRA services, storage and other related expenses when working with this organization. Here is a summary of the various fees and costs:

❑ Shipping fees: American Hartford Gold offers insured shipping at no additional cost, providing a valuable benefit as shipping precious metals can be expensive.

❑ Storage fees: Annual storage and custody fees are based on the account value for gold and other precious metal IRAs. American Hartford Gold generally charges $180 or less for these services.

❑ IRA fees: The company offers a waiver on all IRA fees for the first year if the client purchases over $50,000. Additional promotions may extend this fee waiver for up to three years.

❑ Cash purchases minimum: Cash purchases require a minimum investment of $1,500.

❑ IRA rollover minimum: IRA rollovers have a minimum account requirement of $10,000.

❑ Product prices: Pricing information for specific products is not listed on the company's website. Clients are advised to contact American Hartford Gold directly for pricing details.

Reviews and Ratings

American Hartford Gold has established itself as a reputable and trustworthy dealer in the precious metals industry, garnering positive reviews and high ratings from numerous sources.

The company maintains an A+ rating with the Better Business Bureau and receives an excellent 4.94-star rating based on over 400 reviews. Additionally, it boasts a strong 4.9-star rating on Trustpilot from more than 1,100 reviews and a 4.8-star rating on Google.

Clients praise it for providing comprehensive education and guidance, particularly for those with limited knowledge about retirement investments. The company's representatives are commended for their professionalism, patience and effective communication.

While there may be occasional complaints, often related to the price match guarantee policy, it takes customer feedback seriously and actively works to address and resolve any issues.

Pros and Cons of American Hartford Gold

PROS

Cons

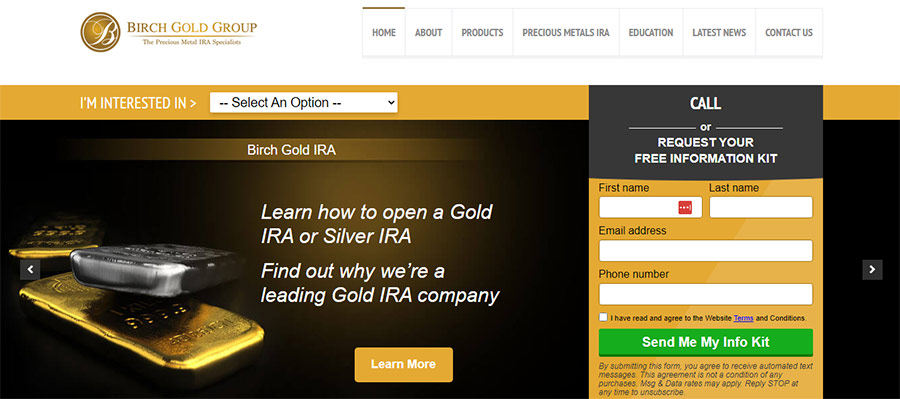

About Birch Gold Group

Birch Gold Group strongly emphasizes customer satisfaction and provides them with the necessary knowledge to make well-informed decisions. It is located in Burbank, California, near Warner Bros. Studios. The company takes pride in serving customers across all 50 states and has gained recognition through extensive coverage in major media channels.

Established in 2003, it is one of the largest distributors of physical precious metals in the United States. With a team of former wealth managers, financial consultants and commodity dealers, they offer a wide range of precious metals, including gold, silver, platinum and palladium.

Regarding vital investments such as retirement and life savings, it is crucial to trust financial service firms that instill complete confidence. The firm is an industry leader in managing gold-based retirement portfolios, catering to the diverse needs of over 14,000 customers throughout its history.

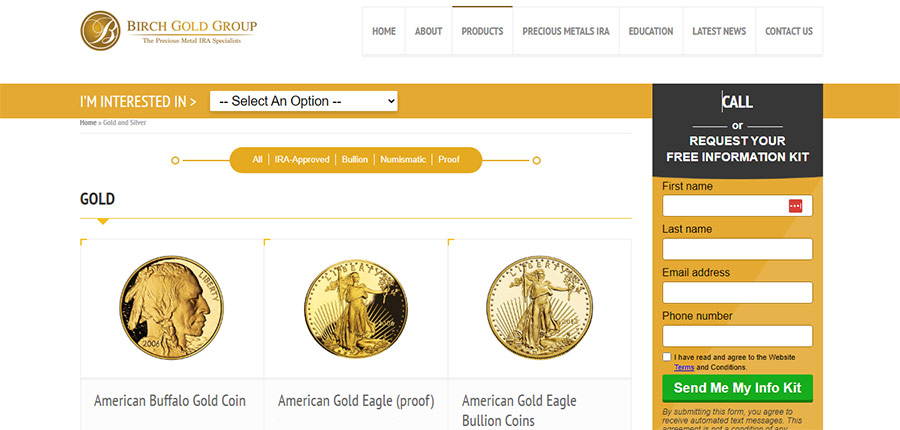

Products and Services

Birch Gold Group provides products and services related to physical gold and silver investments. They offer various IRS-approved metals, including gold, silver, platinum and palladium, ensuring compliance with IRS regulations for self-directed precious metals IRAs. Customers can choose from multiple sizes of coins, bars and rounds.

To ensure the secure storage of these precious metals, it collaborates with reputable storage companies. They offer various storage options, including home storage, bank deposit boxes, offsite vault storage and an online storage system for convenient and secure account management.

In addition to its product offerings, it provides expert guidance and assistance to investors. They advise on selecting the most suitable gold and silver products, facilitate purchasing and selling precious metals and provide comprehensive financial planning and retirement services.

It also specializes in gold and silver IRA accounts, helping investors diversify their retirement portfolios by allocating some of their savings to these precious metals. They assist with setting up and managing these accounts and facilitating rollovers from existing retirement accounts.

Fees and Required Minimum Investment

To open an account with the firm, you will need to make a minimum investment of $10,000. However, if you have an IRA account worth over $50,000 from another traditional IRA that you transfer to Birch Gold Group, they have a special offer for you.

They will waive the custodial fees for the first year, providing added value to your investment. It's important to note that there are one-time costs associated with setting up the account and wire transfers, but beyond the first year, the annual charges for your precious metals IRA account with Birch Gold Group will total $180.

The initial set-up fee is $50 and there is a $30 wire transfer fee. There is an annual maintenance fee of $80 and an annual storage fee of $100. These fees cover managing and storing your precious metals within your IRA account.

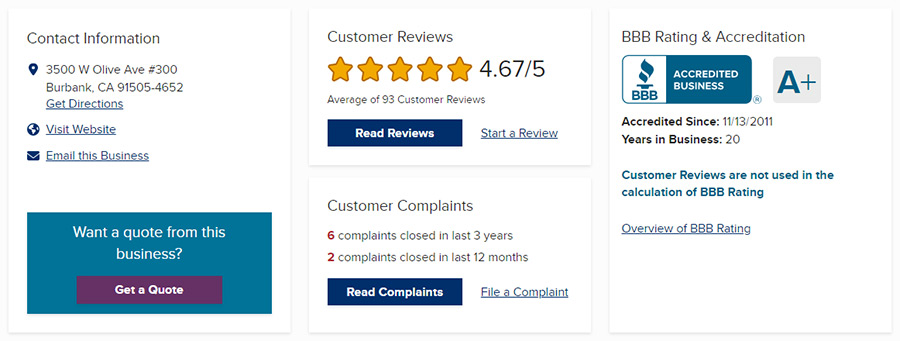

Ratings and Reviews

It has established a strong reputation in the industry, backed by positive customer reviews and ratings across various platforms. They hold an A+ rating with the BBB, based on 72 reviews, with an average rating of 5 out of 5 stars. This reflects the high level of customer satisfaction and the quality of service provided by Birch Gold Group.

On TrustLink, the firm maintains an impressive rating of 4.9 out of 5 stars based on 129 reviews. This platform serves as a trusted source for customer reviews and testimonials, further validating the positive experiences shared by clients.

It has also earned an AAA rating from the Business Consumer Alliance, demonstrating its commitment to ethical business practices and customer service. With seven reviews contributing to this rating, Birch Gold Group continues to build trust and credibility among its clientele.

Google Reviews also highlight the exceptional service provided by Birch Gold Group, with an average rating of 4.8 out of 5 stars based on 220 reviews. These reviews reflect the positive experiences and satisfaction expressed by customers who have engaged with the company.

Furthermore, on TrustPilot, it maintains a stellar rating of 4.9 out of 5 stars based on 125 reviews. This platform further reinforces the company's dedication to providing top-notch service and expertise in precious metals investments.

Pros and Cons of Birch Gold Group

PROS

Cons

5. Noble Gold

About Nolble Gold

Noble Gold is a reputable gold investment and IRA provider operating for over 20 years. Founded by experienced professionals Charles Thorngren and Collin Plume, the company aims to simplify and secure the process of trading precious metals.

Based in Pasadena, California, Noble Gold offers various services, including gold and silver IRAs, helping clients hedge against market volatility by investing in physical gold and silver.

With their extensive experience in the gold market, the company's founders are well-equipped to provide valuable advice to clients and ensure they make the most of their investments.

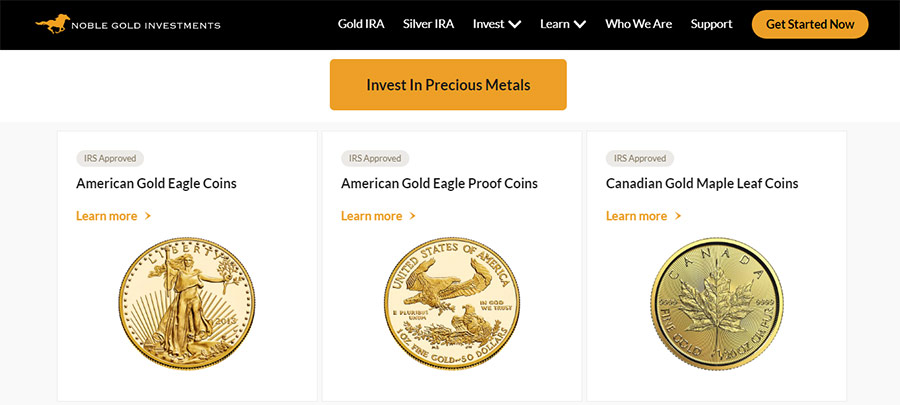

Noble Gold Products and Services

This company offers a range of precious metals, including gold, platinum, silver and palladium. However, their most sought-after offering is their gold IRA service. Unlike traditional IRAs, which rely on paper assets, gold IRAs provide account holders with a store of physical gold.

Many investors prefer gold IRAs because gold tends to retain its value or even increase in times of economic crisis. Noble Gold stands out from other gold IRA brokers by keeping physical gold in stock, allowing investors to access and inspect their investments at any time easily.

Opening a gold IRA with the company is straightforward, whether you want to invest cash or transfer an existing retirement account. They accept rollovers from various retirement accounts, including SIMPLE IRAs, Roth IRAs, 401(k)s, 403(b)s, TSPs and 457(b) plans.

Noble Gold Investments offers services such as silver IRAs, Bitcoin investments and rare precious metal coins. They assist in setting up tax-efficient gold investments and help clients maximize available deductions.

Fees Information

The firm charges an annual subscription fee of $80, which remains consistent regardless of the amount of gold held in the IRA. For gold IRA storage in Texas or Delaware, the cost is $150 per year.

This flat rate covers all expenses related to securing your gold, including segregated storage, insurance and access to a real-time online account for monitoring your holdings. This ensures that your gold is kept safe and easily accessible.

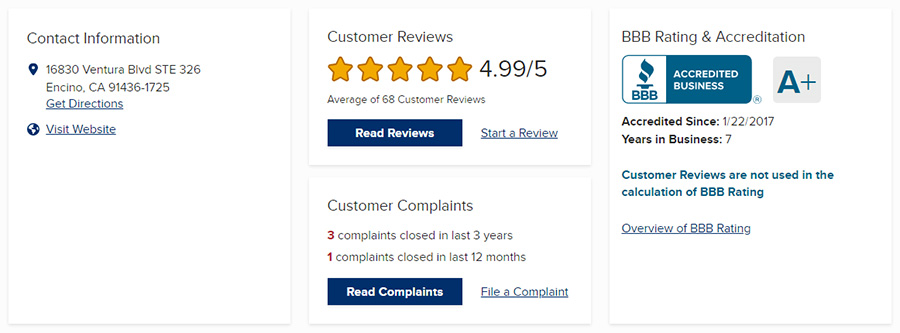

Reviews and Ratings

Noble Gold has garnered consistently positive reviews from various sources. It has received an "A+" ranking from Scam Risk, indicating its trustworthy reputation. The company has also achieved an "AA" rating from the Consumer Alliance, reflecting high customer satisfaction.

Customer reviews on the BBB website give it an average rating of 4.8 stars out of 5, with clients expressing satisfaction with the company's superior approach to gold IRAs. These positive reviews highlight the trustworthiness and customer satisfaction associated with Noble Gold.

Pros and Cons of Noble Gold

PROS

Cons

Conclusion

When investing in gold through an IRA, you want to choose a top provider that offers exceptional support and a range of benefits. After considering various options, we recommend Goldco as the leading choice for your gold IRA needs.

They go above and beyond to provide white-glove services that cater to your financial goals while keeping costs reasonable.

With Goldco, you can expect a seamless experience and expert assistance, making them an ideal choice, especially for first-time investors. Their reputation as a top gold IRA provider speaks for itself and they are known for their outstanding service quality.

If you're ready to dive into the world of precious metals and gold IRA investing, don't miss out on the opportunity to explore what Goldco has to offer. Take action now and discover the benefits of working with a trusted and reliable partner like Goldco.

FAQs

▶ Is My Gold IRA Tax-Free?

A Gold IRA can offer tax advantages, such as potential tax-deferred growth or tax-free withdrawals, depending on the type of IRA and the specific circumstances.

▶ How Much Should I Contribute to My IRA?

The amount you should contribute to your IRA depends on various factors, including income, age and financial goals. Still, it's generally recommended to contribute as much as you can afford up to the annual contribution limit set by the IRS.

▶ What's the Difference Between Roth and Traditional IRAs?

The main difference between the two is how they are taxed: contributions to a traditional IRA are typically tax-deductible, but withdrawals in retirement are subject to taxes, while Roth IRA contributions are made with after-tax money, but qualified withdrawals in retirement are tax-free.

▶ How Do I Withdraw From My IRA?

You must follow certain rules when you wish to withdraw funds from your IRA:

1️⃣ Remember that withdrawals from a traditional IRA are generally subject to income tax, while Roth IRA withdrawals are usually tax-free if certain conditions are met.

2️⃣ If you withdraw funds from a traditional IRA before age 59 ½, you'll be charged 10% early withdrawal penalty if you don't qualify for an exception.

3️⃣ For both traditional and Roth IRAs, you are required to start taking minimum distributions, known as Required Minimum Distributions (RMDs), by a certain age (currently 72 for traditional IRAs and 70 ½ for Roth IRAs) to avoid penalties.