Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

If you are considering investing in gold and want to avoid the challenges and risks of owning physical gold, a gold IRA might be your ideal solution. Oxford Gold Group offers a particularly advantageous option among the various gold IRAs. In this article, we will explore the advantages of investing in gold through Oxford Gold Group's IRA service and illustrate why it is the right alternative for you.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

About Oxford Gold Group

The headquarters are located in the vibrant city of Los Angeles, California. Although the company is relatively new, starting its operations in 2017, the founders, including the knowledgeable Patrick Granfar, have been involved in the precious metals trade for nearly two decades. Their extensive experience and passion for serving clients have driven their remarkable growth.

At Oxford Gold Group, they take pride in being market leaders in gold investments. They understand your needs and have tailored their services to meet them. Whether you're interested in gold or silver self-directed IRAs, they've got you covered. And if retirement planning is on your mind, they've got you covered there too! They are there to assist you every step of the way.

Now, if you're not too keen on IRAs, no worries! Oxford Gold Group provides exciting options for metals trading as well. It's not just about owning a shiny piece of gold; it also comes with incredible tax advantages! If you have gold in your retirement account and decide to sell it, guess what? You won't have to pay a single penny in taxes on the profit you make.

Oxford Gold Group Main Highlights

Investing in precious metals through Oxford Gold Group's services provides IRA holders with a simplified approach. For investors seeking a more secure option than paper IRAs, the company's gold IRAs have emerged as an excellent choice. Gold IRAs offer greater resilience against inflation and market volatility than traditional IRAs.

When you open a gold IRA with Oxford Gold Group, you receive physical gold bullion, which the company securely holds on your behalf. It means that until your retirement age, your gold remains safe and protected. When the time comes, you can withdraw or sell any gold within your retirement account.

Knowing that your gold is in the trustworthy hands of Oxford Gold Group until retirement brings peace and security. If you need guidance on building your nest egg for retirement, you can consult a partner at Oxford Gold Group, who can provide expert advice tailored to your needs.

Investing in gold IRAs through Oxford Gold Group offers a cost-effective solution compared to other dealers. The process of opening a gold IRA is quick and straightforward. You can fill out a brief online form or call the firm and they will handle the rest for you.

Customers with experience dealing with Oxford Gold Group have generally expressed satisfaction with their gold IRAs and have appreciated the company's efficiency, customer assistance and honesty.

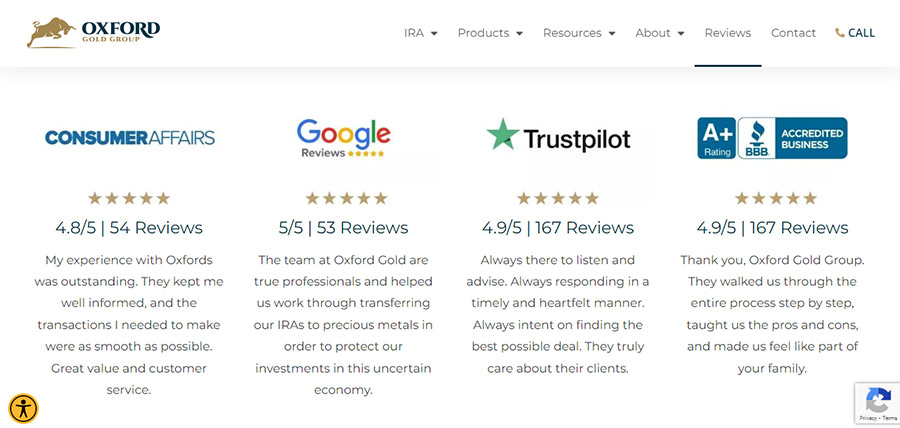

Oxford Gold Group holds an impressive 4.8 Trustpilot rating and has received an A+ rating from the BBB (Better Business Bureau). Additionally, esteemed sources like Retirement Living and Consumer Affairs recognize Oxford Gold Group as a top gold IRA provider, awarding it a star rating of 4.5 out of 5 stars.

Oxford Gold Group Products and Services

Regarding online marketplaces for trading precious metals, Oxford Gold Group stands out as a top choice. They offer many precious metals, including gold and silver coins and bars. In addition, customers can also find palladium and platinum products available for purchase.

Oxford Gold Group provides options like gold and silver IRAs for individuals looking to diversify their portfolios beyond precious metals. Opening a gold IRA account with them is incredibly efficient, with the entire process typically taking around 15 minutes over the phone or online. You'll need your driver's license, retirement account statement and beneficiary information.

Once your account is set up, you can fund it through various methods, such as direct deposits, transfers, or rollovers from other retirement accounts. You will receive physical gold coins and bars in exchange for the deposited amount, ensuring tangible ownership rather than paper or certificate items.

Oxford Gold Group's customers can store their gold in a secure depository. While occasional inspections are permitted, actual withdrawals are not allowed. It's important to note that any gold taken out of an IRA before the owner reaches the age of 59½ is subject to taxation and a 10% early withdrawal penalty.

Managing your investment portfolio is easy with an Oxford partner's active involvement. If you desire assistance in creating an investment strategy tailored to your unique needs and those of your family as you approach retirement, you can always reach out to one of their partners.

When it comes to retirement, you can withdraw the gold from your retirement account or have an Oxford partner handle it. Thanks to the comprehensive support provided by Oxford's partners, the entire process is simple and stress-free, ensuring a smooth transition into your golden years.

Pricing

Oxford Gold Group implements a yearly fixed cost when maintaining precious metals IRAs. The exact amount of the yearly maintenance charge ranges between $175 and $275, depending on the size of your IRA.

The collaboration between Oxford Gold Group and trusted partners like Strata Trust Company and Equity Institutional allows for a streamlined fee structure. This collaboration has standardized services and expenses, enabling Oxford Gold Group to offer a flat fee structure to consumers. Moreover, customers with larger accounts are eligible for rebates that effectively reduce their monthly maintenance rates.

For those with significant accounts, these rebates can span a considerable period, resulting in a prolonged time frame during which the average Oxford Gold Group IRA client does not have to pay any maintenance or storage costs for the initial three years of the rebate program.

While the storage fee paid by Oxford Gold Group may vary depending on the chosen vault service, the typical annual storage cost falls within the range of $175 to $225. Notably, Oxford Gold Group provides a return of one to five years for storage expenses paid, based on the quantity of the investment. This ensures that your storage costs are effectively mitigated over time.

Regarding shipping costs, Oxford Gold Group waives such fees, providing added convenience to investors. It's important to note that, like with any investment, commission costs are incurred when you buy or sell precious metals through Oxford Gold Group. However, brokerage fees are not applicable.

To invest in precious metals, a minimum of $7,500 is required for an IRA or $1,500 outside of an IRA. When it's time to sell your assets, investors can take advantage of both the buy-back program and the no-fee liquidation programs offered by Oxford Gold Group, ensuring a seamless and cost-effective process.

With transparent pricing and various cost-saving measures, Oxford Gold Group strives to provide customers with competitive rates and exceptional value for their precious metals investments.

Storage Options

When you choose to purchase a gold IRA from Oxford Gold Group, you won't physically receive the gold bullion. Instead, the company ensures its safekeeping in secure locations. Rest assured that several private institutions, independent of banks and government entities, meet the IRS requirements for safeguarding gold.

Among the reputable storage options available, you can opt for renowned institutions like Brinks Global Services - USA and the Delaware Depository, to name a few. These facilities offer storage locations across the United States, including some with the advantage of being located in areas where taxes on the purchase or sale of precious metals don't apply. You can choose a convenient location that suits your preferences and visit to see how your gold performs.

Concerned about the safety of your gold while it's in storage? Each depository facility partnered with Oxford Gold Group is equipped with the latest security measures and is backed by comprehensive all-risk insurance provided by Lloyd's of London. This ensures that your precious metals are protected against unforeseen events and gives you peace of mind knowing that your investment is in capable hands.

The InnerWorkings of Precious Metals Investing

Investing in precious metals like gold bullion can offer you undeniable value. With self-directed retirement plans like gold-backed IRAs, you have a valuable opportunity to diversify and secure your retirement portfolio.

When you partner with an Oxford Gold dealer, you can rest assured that your retirement account (IRA) will be carefully stocked with the appropriate metals. They will be securely stored, following IRA storage requirements and managed by qualified professionals.

Unlike traditional investments that involve purchasing company shares, investing in a gold IRA lets you physically possess gold or other precious metals. Owning these tangible assets provides security, especially if you are concerned about the dollar's value or the stock market's stability. By holding precious metals in physical form, you eliminate the risks of relying solely on computer records that could be compromised or prone to errors.

Compared to other valuable assets like diamonds and precious stones, precious metals like gold are a better choice. Unlike certain markets controlled by monopolies, trading precious metals is more accessible and straightforward.

It's important to remember that gains and losses from your gold IRA, like other IRAs, must be reported to the Internal Revenue Service (IRS) on tax form 1099-B. By complying with tax regulations, you ensure transparency and adhere to legal requirements.

It's common for customers to request individual compartments for storing their precious metals to cater to their preferences. This makes it easier to retrieve the metals when you decide to sell them in the future, adding convenience to your investment strategy.

When engaging in substantial asset sales or exchanges exceeding $10,000 within 24 hours, it's essential to follow IRS guidelines. Make sure to file Form 8300 and the professionals at Oxford Gold Group can assist you throughout this process.

Should You Add Gold to Your IRA?

Adding gold to your IRA offers a range of benefits:

➡️ Diversification: By incorporating gold into your IRA, you introduce a valuable asset that helps spread risk and diversify your investment portfolio. Diversification is crucial for minimizing the impact of market volatility on your overall retirement savings.

➡️ Hedge Against Inflation: Gold has a long-standing reputation as a hedge against inflation. Unlike paper currencies, the value of gold tends to hold its purchasing power over time. Including gold in your IRA can help protect your savings from the eroding effects of inflation and preserve your wealth.

➡️ Mitigate Market Volatility: Gold's performance often moves independently from other asset classes, such as stocks and bonds. This characteristic makes it an effective hedge against market volatility. When other investments experience significant fluctuations, gold can act as a stabilizing force, helping to cushion your portfolio from sharp downturns.

➡️ Preservation of Buying Power: As gold is not tied to any specific currency, its value remains relatively stable over the long term. By investing in gold, you can preserve your buying power and maintain the value of your retirement savings, even during economic uncertainty or market turbulence.

➡️ Potential for Long-Term Growth: While gold is considered a safer investment, it still has the potential for long-term growth. Over time, gold prices have historically shown upward trends, providing the opportunity for favorable returns. By including gold in your IRA, you can enhance your long-term earnings while minimizing the risk associated with more volatile assets.

How Do You Fund a Gold IRA?

Funding a gold IRA can be accomplished through a rollover from an existing IRA or a direct transfer from another trustee. This process, known as a "trustee-to-trustee transfer," allows you to move funds from your current retirement account to your new gold IRA.

Depending on your current retirement account custodian, the money transfer can be completed in as little as five business days. Typically, these funds are transferred through a bank wire.

When you make transfers within the Oxford Gold Group, you won't incur any taxes or penalties from the Internal Revenue Service (IRS). Additionally, there are no restrictions on the number of transactions you can initiate.

If you opt for a rollover to another IRA, your existing retirement account custodian will send you a cheque. It's important to note that you have 60 days to deposit the full cheque into your gold IRA account, representing your retirement savings. Failure to do so may result in fines or additional taxes.

The Oxford Gold Group is here to assist you throughout the process. They can guide you in choosing the right strategy and handle all the necessary paperwork, ensuring a seamless experience. If you need advice on financing your gold IRA, the firm can provide recommendations based on your situation.

Procedure for Opening a Precious Metals IRA

Opening a precious metals IRA may seem more complex than a standard IRA, but you can navigate the process smoothly with the right guidance. Here's a step-by-step guide to help you open a retirement account for precious metals.

Select a Custodian for Your Self-Directed IRA

Select a custodian who is authorized to handle self-directed IRAs that include bullion. Look for an IRS-approved bank or financial institution that can provide the necessary services. Ensure you trust the custodian and consider the associated expenses of maintaining the IRA.

Identify a Dealer in Precious Metals

Once you have a custodian, the next step is to choose a reputable dealer who will buy precious metals on your behalf. Do thorough research to find a reliable dealer. Look for dealers who are members of professional organizations like the American Numismatic Association, the Professional Numismatists Guild, or the Industry Council of Tangible Assets. Consult your IRA service provider if you need guidance, as they often partner with trusted organizations.

Choose the Metal Products

Explore the range of products offered by your chosen dealer. Consider market conditions and your personal preferences. If you're new to investing in precious metals with your IRA, start with popular options like American Gold Eagles or Gold Buffaloes. You can also consider coins like Canada Maple Leaf or Australian Koala Bullion. Remember that different dealers specialize in different metals, such as gold, silver, or platinum coins.

Select Safe Deposit Box

Remember that the company managing your precious metals IRA is not responsible for the security of your metals. Look for trusted depository institutions approved by the IRS, such as Delaware Depository Service, Brinks, or International Depository Service. Choose a safe deposit box that suits your needs regarding location and cost. Opting for a closed vault adds an extra layer of security for your stored valuables.

Make the Purchase

Once you have selected, it's time to finalize the purchase. Your custodian, IRA administrator, or depository service can assist you with the necessary paperwork and financial management. Keep track of the total value of your orders and store the records safely for future reference.

Customer Complaints and Ratings

Oxford Gold Group has earned an exceptional reputation in terms of customer satisfaction, as reflected in its high ratings and positive reviews. On TrustPilot, a reputable review platform, the company boasts an impressive 4.9-star rating.

A remarkable 95% of consumers have rated their experience with Oxford Gold Group as excellent, while the remaining 5% have deemed it outstanding. Such overwhelming praise is a testament to the company's commitment to providing quality service.

While Oxford Gold Group has undoubtedly garnered significant acclaim, it is important to acknowledge that no business is without its challenges. Some customers have reported certain issues, shedding light on areas where improvements could be made.

Notably, the company's support staff availability has been a concern raised by customers. Limited hours of availability have been a point of frustration for some individuals seeking assistance. This feedback highlights an aspect of the company's operations that could be further addressed to enhance customer experience.

Despite these minor concerns, it is worth noting that the Better Business Bureau (BBB), an organization that tracks formal complaints and evaluates businesses, has awarded Oxford Gold Group a five-star rating. This recognition speaks to the company's commitment to maintaining high standards and resolving customer issues effectively.

It is important to acknowledge that, at the time of writing, a solitary consumer complaint was registered with the BBB regarding a refund-related problem to provide a balanced perspective. While this complaint represents an isolated incident, it underscores the need for continued diligence and improvement in customer service to ensure complete customer satisfaction.

Final Thoughts

Oxford Gold Group presents a viable option for individuals seeking to include gold, silver, or other precious metals in their investment portfolio within an IRA. With its established presence in the industry, the company offers a range of products and services to cater to the needs of its customers.

While it is important to acknowledge that there have been consumer complaints against Oxford Gold Group on platforms such as the Better Business Bureau (BBB) and other websites, it is noteworthy that the company responds to these issues professionally and promptly. This indicates a commitment to addressing customer concerns and resolving them to the best of their ability.

When considering any investment decision, conducting thorough research, reviewing customer feedback and assessing the company's reputation are crucial. This applies to Oxford Gold Group as well. While there have been some complaints, it is encouraging to see the company taking steps to address them.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<