Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

New Direction Trust Company stands out as one of the best self-directed IRA firms we have reviewed and its commitment to diversity and inclusion is commendable.

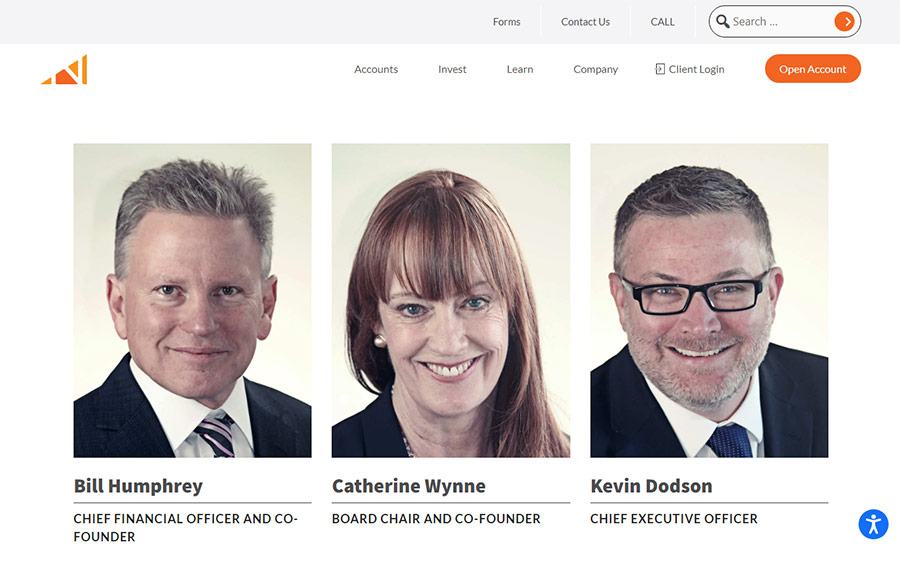

Unlike many other companies in the investing industry, New Direction Trust Company boasts an executive and management team with an equal representation of male and female professionals. This level of gender balance is rare and speaks volumes about the company's progressive approach.

Beyond its dedication to diversity, New Direction Trust Company receives high customer praise across various platforms. The positive customer reviews attest to the company's strong reputation and the satisfaction of its clients.

In terms of offerings, New Direction Trust Company provides a comprehensive range of account types and investment options, ensuring investors can choose their needs.

Their fee structure is competitive within the industry, with a combination of annual administration fees, account value-based fees and asset-based fees. This variety of options demonstrates the company's commitment to accommodating diverse investors.

Throughout our review, we provide answers to frequently asked questions, detailed information on product features and insights into the advantages and benefits offered by New Direction Trust Company. This review will give you a detailed understanding of the company's direction and how it can contribute to your retirement planning.

While New Direction Trust Company may be a strong contender for your retirement needs, we encourage you to explore our other reviews. Considering all options to make an informed decision that aligns with your goals and requirements is crucial.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

Company Management

Catherine Wynne and Bill Humphrey founded New Direction IRA and their open approach to sharing information about the company's management is a positive sign of transparency and trustworthiness.

Bill Humphrey brings over 20 years of experience as a Certified Public Accountant. He holds a Bachelor of Science in Business from the University of North Carolina. He has further enhanced his expertise through graduate studies in Finance, Accounting and Economics at the University of Colorado in Boulder.

On the other hand, Catherine Wynne focuses on customer operations and education. She has a background in teaching at the University of Denver Law School, which adds to her knowledge and understanding of the industry.

New Direction IRA readily discloses information about its founders and management team, which speaks volumes about its commitment to transparency. New Direction IRA's willingness to showcase the people driving the company is a positive indicator in an industry where some firms operate behind a veil of secrecy. It suggests they are less likely to be involved in scandals or questionable practices.

Detailed information can be found on their 'About Us page for those interested in learning more about the company's management.

New Direction Trust Company Investing Account Options

New Direction Trust Company offers a comprehensive range of account types for investors' retirement planning needs. Here are the account options available:

Investment Options at New Direction Trust Company

New Direction Trust Company provides many investment options within their self-directed IRA accounts. Here are some of the investment options available to their clients:

Real Estate

Investing in real estate is a popular choice among self-directed IRA investors. New Direction Trust Company allows clients to invest in various real estate types, including residential, commercial and rental properties. Investors can benefit from property appreciation, rental income and potential tax advantages.

Precious Metals

Another popular option New Direction Trust Company offers is investing in precious metals, such as gold, silver, platinum and palladium. Clients can allocate some of their self-directed IRA funds to purchase and hold precious physical metals to hedge against inflation or market volatility.

Private Lending

Clients have a chance to engage in private lending within their self-directed IRAs. This involves providing loans to individuals or businesses and earning interest on the loan amount. Private lending can diversify an investment portfolio and provide consistent returns.

Private Equity

New Direction Trust Company enables investors to participate in private equity investments through their self-directed IRA accounts. Private equity investments involve investing in privately held companies or private investment funds, offering potential opportunities for higher returns.

Checkbook IRA

New Direction Trust Company, like other providers, offers a Checkbook IRA option. This involves setting up an IRA under a limited liability corporation (LLC), allowing investors to have checkbook control over their IRA funds. This flexibility allows clients to easily make investments, issue checks and manage their IRA funds.

Other Investments

New Direction Trust Company emphasizes the freedom to invest in a wide range of opportunities outside the traditional investment options. Clients can explore alternative investments such as startups, green technologies, private placements and more.

To pursue these opportunities, investors can consult with the company's staff to discuss their specific interests and investment goals.

New Direction Trust Company Fee Schedule

New Direction Trust Company employs a fee structure similar to other IRA providers. They generate revenue by charging fees to their clients and their fee schedule is comprehensive and detailed.

There are various approaches to fee-charging, including asset-based fees, percentage-based fees and flat fees on a monthly, quarterly or annual basis. New Direction Trust Company utilizes a combination of these approaches.

Annual Administration Fees

One category of fees New Direction Trust Company charges is annual administration fees. These fees apply to different accounts, such as precious metals, publicly traded securities, digital currencies and discount brokerage accounts.

The specific fee amount depends on the account value, with higher fees applicable for accounts exceeding $100,000.

For precious metals accounts with a value below $100,000, the annual administration fee is a flat $95. If the account value exceeds $100,000 and includes precious metals, the annual fee for online trading is $150.

Similarly, Digital currency accounts start at $250 annually, reflecting the market's volatility. The fee for trading publicly traded securities is $95 per year. These fees align with industry standards and can vary depending on the account value and type.

Privately Held Assets

New Direction Trust Company allows investors to choose between asset-based or account value-based fees for privately held assets. For asset-based fees, clients are charged based on the number of assets they hold. Account value-based fees range from $195 for accounts valued below $14,999 to $1,850 for accounts valued above $750,000.

Processing Fees and Other Fees

In addition to the annual administration fees, New Direction Trust Company charges clients for various services. These include processing checks, bank wire transfers, late fees, statements, void checks and mail delivery.

The fees for these services typically range from $5 to $40, depending on the specific task. Any special services not covered by the fee schedule are billed at $150 per hour.

Customer Support

New Direction Trust Company provides multiple channels for customer support and communication. They prioritize accessibility and offer various means to reach clients and interested individuals.

📞 Phone Support

New Direction Trust Company prominently displays their phone numbers on the top right corner of their homepage. This makes it simple for customers to quickly find the contact information they need and speak directly with a representative.

By offering phone support, New Direction Trust Company ensures that clients have a direct line of communication for immediate assistance or inquiries.

✉️ Email Communication

In addition to phone support, New Direction Trust Company offers an email contact option. They have a contact form on their website that allows individuals to submit their questions or concerns electronically.

This provides an appropriate way for clients to communicate with the company, especially if they prefer written correspondence or have more detailed inquiries.

🕒 Consultation Scheduling

New Direction Trust Company understands the importance of personalized support and offers the option to schedule consultations in advance. This allows clients to have dedicated time with a representative to discuss their specific retirement planning needs, investment options or any other relevant topics. Scheduling a consultation ensures that clients can receive focused attention and tailored guidance.

📲 Live Chat

While New Direction Trust Company does not currently offer a live chat feature, it is worth noting that this is not uncommon in the IRA industry. Many IRA companies primarily rely on phone and email support and live chat may not be widely available.

Although live chat can provide real-time assistance, its absence should not be a significant deterrent, as New Direction Trust Company offers other convenient means of communication.

Customer Reviews

New Direction Trust Company has garnered various customer reviews across different platforms, a common occurrence for IRA providers. When assessing customer reviews, it is important to consider the varied nature of feedback and exercise discernment.

On Google business profiles, New Direction Trust Company has received a commendable rating of 4.7 out of 5 stars based on 155 reviews. This high rating reflects an overall positive sentiment from clients who have shared their experiences on this platform, positioning New Direction Trust Company as one of the top performers among IRA providers.

Similarly, on the Better Business Bureau (BBB) website, New Direction Trust Company holds a perfect 5-star rating. The company's long-standing presence in the industry, with 16 years of operation, contributes to its A+ rating on the BBB site. This positive rating demonstrates the company's commitment to customer satisfaction and service quality.

However, New Direction Trust Company has a more mixed review profile on Yelp. With only 16 reviews collected on this platform, the company receives an average rating of 2.5 out of 5 stars.

Yelp reviews may not fully represent the overall customer sentiment, as the sample size is relatively small compared to other platforms.

Considering the overall customer feedback, New Direction Trust Company has a strong reputation and positive customer experiences. While some negative reviews on certain platforms may exist, most customers have expressed satisfaction with the company's services.

Why Invest in Precious Metals IRA?

Investing in a Precious Metals IRA can offer several benefits and advantages for investors.

Portfolio Diversification

Precious metals, such as gold, silver, platinum and palladium, diversify a portfolio primarily composed of traditional assets like stocks and bonds.

Precious metals tend to have a low correlation with other asset classes, meaning their value often moves independently from traditional investments. This can reduce overall portfolio risk and provide a hedge against market volatility.

Inflation Hedge

Precious metals have historically served as a reliable hedge against inflation. When inflation rises, the value of fiat currencies tends to decline, while the price of precious metals typically rises. Investing in precious metals can help protect the purchasing power of your investment portfolio during periods of inflation.

Store of Value

Precious metals have been recognized as a store of value for thousands of years. Unlike paper currencies, which can be subject to fluctuations and devaluations, precious metals have inherent value and are widely accepted globally.

They have proven their ability to retain value over time, making them a tangible asset that can preserve wealth.

Potential for Capital Appreciation

Precious metals, especially gold and silver, have the potential for long-term capital appreciation. While the prices of precious metals can experience short-term fluctuations, they have shown a tendency to increase in value over the long term.

Economic and geopolitical uncertainties and increased demand for precious metals in industries such as jewelry and technology can contribute to their price appreciation.

Liquidity

Precious metals, particularly gold and silver, are highly liquid assets. They can be easily purchased or sold, including bullion bars, coins and exchange-traded funds (ETFs). This liquidity provides flexibility and enables investors to convert their precious metals holdings into cash relatively quickly when needed.

Tangible Asset Ownership

Investing in a Precious Metals IRA lets you own physical assets like gold, silver or other precious metals. This tangible ownership can provide security and peace of mind, knowing you have a physical asset with inherent value.

Retirement Planning

A Precious Metals IRA allows individuals to include precious metals in their retirement savings strategy. By holding precious metals within an IRA, investors can enjoy potential tax advantages, such as tax-deferred or tax-free growth, depending on the type of IRA chosen (Traditional or Roth IRA).

Getting Started with Precious Metals IRA

Setting up a precious metals IRA involves several steps. Here's a breakdown of the process:

Research and Select a Reputable Custodian

Start by researching and choosing a custodian specializing in self-directed IRAs for precious metals. Look for custodians with a solid reputation, extensive industry experience and various investment options. Consider factors such as fees, customer reviews and the quality of customer service.

Open an Account

Once you have selected a custodian, you must open a precious metals IRA account with them. This typically involves completing an application form and providing necessary identification and documentation, such as your social security number and proof of address.

Fund Your Account

After opening the account, you need to fund it. You can transfer funds from an existing retirement account, such as a traditional IRA or 401(k), through a direct or indirect rollover. Alternatively, you can make a new contribution to your precious metals IRA, subject to IRS contribution limits and eligibility criteria.

Choose the Precious Metals

With your account funded, it's time to choose which precious metals you want to invest in. Common options include gold, silver, platinum and palladium. Consider factors such as historical performance, current market trends and your investment goals and risk tolerance.

Ensure that the metals you choose comply with IRS regulations for inclusion in an IRA.

Purchase the Precious Metals

Once you have made your investment choices, work with your custodian to facilitate the purchase of the precious metals. The custodian will guide the buying process and handle the necessary paperwork. They will ensure that the metals are acquired in the name of your IRA and meet all IRS requirements.

Arrange for Secure Storage

Precious metals in an IRA must be stored in an approved depository or storage facility. Your custodian will assist you in selecting a reputable storage provider that meets IRS standards for security and compliance.

The storage facility will safeguard your precious metals and provide periodic reporting to you and your custodian.

Manage and Monitor Your Account

Once your precious metals are purchased and securely stored, you must actively manage and monitor your IRA account. This includes staying informed about market trends, evaluating the performance of your investments and making any required adjustments to your portfolio.

Your custodian will provide regular account statements and reporting to keep you updated on the status of your precious metals holdings.

Final Thoughts

New Direction Trust Company stands out as a specialist in self-directed IRAs, offering a wide range of investment options to their clients. Their emphasis on alternative assets like real estate and precious metals allows investors to diversify portfolios.

However, it's important to note that New Direction Trust Company does not cover the storage costs associated with precious metals, which can be a drawback for some investors.

One area where New Direction Trust Company could improve is its fee structure. They charge termination and setup fees that may be higher than their competitors, such as Equity Trust. Additionally, the sliding scale fee that increases for accounts over $100,000 may disadvantage some investors.

Despite these drawbacks, New Direction Trust Company has garnered positive reviews and ratings, showcasing its commitment to customer satisfaction. Investors interested in self-directed IRAs and alternative asset investments may find value in working with New Direction Trust Company.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<