Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

In today's economic climate, many individuals seek secure investment options to protect their wealth and avoid significant losses. Some investors opt for hedging their investments against inflation as a prudent strategy to maintain their purchasing power over time.

Meanwhile, others may be attracted to high-risk ventures due to their potential for substantial returns.

When considering investment options, precious metals like gold, silver, platinum and palladium often come to mind. These metals hold intrinsic value and are recognized widely as suitable investments.

Investing in precious metals can serve as a means to safeguard against inflation, as their value tends to increase over time, even when other assets experience downturns.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

However, experts strongly recommend portfolio diversification as a critical strategy for wise investments. Individuals can mitigate risks and optimize their returns by diversifying their portfolios across various asset classes, such as stocks, bonds, real estate and commodities like precious metals.

This approach allows investors to benefit from the performance of different sectors while reducing their exposure to the volatility of any single investment.

For individuals interested in investing in precious metals, reputable platforms are available to facilitate such transactions. One unique platform is the Hard Assets Alliance (HAA).

This registered innovative metals trading club provides a reliable online platform for investing in precious metals, including silver, gold, palladium and platinum.

Using the internet, the Hard Assets Alliance offers individuals a secure and convenient avenue to invest in precious metals.

About the Company

A team of knowledgeable scholars established Hard Assets Alliance to facilitate online investments in precious metals. What sets Hard Assets Alliance apart from other online precious metal investment firms is its commitment to providing customers with 100% genuine investments.

Unlike organizations that solely offer virtual metals, Hard Assets Alliance ensures that when you purchase gold, for example, physical gold is reserved in your name.

One of the key advantages of investing in precious metals is their ability to retain value even in the face of declining government-issued currencies due to inflation.

This makes them a reliable store of wealth, providing investors with peace of mind during periods of economic uncertainty and market collapses. Given their historical track record, silver and other precious metals are increasingly sought after as safe-haven investments.

In addition to its genuine precious metal offerings, Hard Assets Alliance stands out from its competitors by providing clients with a wide range of unique metal portfolios and other related investment products.

With over $2.5 billion in assets today, the hard assets financing industry has a proven history of dynamic account management, exceptional client service and a trustworthy platform.

Hard Assets Alliance embraces the technological advancements of our time, allowing clients to receive top-notch support around the clock from anywhere in the world.

Through their investments in digital assets, clients can access their accounts and make transactions via the Hard Assets Alliance app, available for download from the Apple App Store or the Google Play Store. This empowers users to manage their investments conveniently and securely, 24/7.

Hard Assets Alliance has partnered with Gold Bullion International, an esteemed company based in New York, to ensure the best possible service. This partnership further enhances the quality and reliability of the services provided to clients.

For individuals interested in investing with Hard Assets Alliance, the minimum purchase value is $1,000, subject to shipping and storage expenses for both inbound and outbound transactions in and out of the United States.

This ensures that investors of various scales can access their investment offerings while maintaining transparency regarding associated costs.

Product Offerings

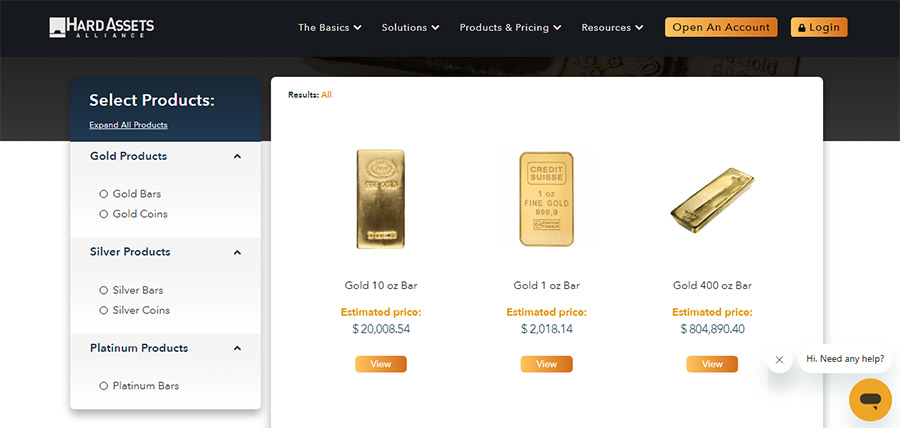

Hard Assets Alliance offers a comprehensive range of products in the precious metals category. They provide various services to cater to the needs of investors, such as secure special metal storage, company accounts and individual accounts.

❑ Gold

Hard Assets Alliance offers a diverse selection of gold products, allowing investors to diversify their portfolios effectively. Investors can choose from physical gold coins and bars, including popular options like American Eagle coins, Canadian Maple Leaf coins and 1-ounce gold bars.

Additionally, they provide access to gold-backed securities such as ETFs (Exchange-Traded Funds), mutual funds, certificates and gold exchange-traded notes. These investment options enable investors to participate in gold price movements without owning the metal.

Hard Assets Alliance also provides educational resources to assist investors in gaining a better understanding of gold investment options.

❑ Silver

Hard Assets Alliance offers a wide array of silver products, catering to those seeking portfolio diversification and tangible assets. Silver is an affordable option that provides both stability and growth potential.

Investors can choose from various silver investment options, including silver coins, bars, rounds and bullion. Silver coins, such as American Silver Eagles, Canadian Silver Maple Leafs and Australian Silver Kangaroos, allow investors to own a piece of history and a physical asset.

Silver bars provide an efficient means to acquire a large amount of silver at once, typically containing 1,000 ounces each. Silver rounds, available in different sizes and designs, appeal to investors and collectors.

Hard Assets Alliance offers competitive prices for all these silver products, empowering investors to make informed investment decisions.

❑ Platinum

Hard Assets Alliance enables investors to purchase platinum with a purity of up to 0.995% at approximately $1,105 per ounce. Platinum is not available in monetary form and must be acquired in ounce quantities.

❑ Palladium

Similar to platinum, palladium coins are not offered by Hard Assets Alliance. The average price for an ounce of palladium is around $2,430. Palladium's increasing demand can be attributed to its use in catalytic converters for fuel-powered vehicles.

Account Types Offered by Hard Assets Alliance

Hard Assets Alliance offers various types of specialized accounts to cater to the diverse needs of their customers:

Hard assets alliance collaborates with trusted vaulting partners in the United States, United Kingdom and European Union to ensure the security and integrity of stored metals for estate and trust accounts.

To access these account types, customers can visit the solutions menu on the Hard Assets Alliance website, where they will find a drop-down option labeled "accounts." Upon deciding the most suitable account type for their needs, users can sign up and go through a verification process to comply with Know Your Customer (KYC) regulations.

Once the account setup is complete, customers gain full access to the market and can start investing according to their chosen account type.

Storage Options & Shipping

Hard Assets Alliance offers a comprehensive range of storage and shipping options to cater to the diverse needs of its clients. HAA provides both domestic and international solutions. Clients can securely store their physical gold, silver and platinum bullion in vaults in the United States, Canada or Switzerland, depending on their preferences and requirements.

Regarding shipping, HAA offers multiple options to accommodate various budgets and needs. Clients can choose from trusted shipping carriers like FedEx, UPS or USPS. HAA works closely with these carriers to ensure the safe and secure delivery of precious metals to their designated destinations.

HAA offers complete insurance coverage for all shipments to provide additional peace of mind, ensuring clients' investments are protected throughout transportation.

For clients looking to ship their precious metals internationally, HAA offers a range of shipping options tailored to meet the unique requirements of international transactions.

They handle all the necessary paperwork and documentation, providing hassle-free and efficient international shipping services. Complete tracking and monitoring of shipments are implemented to ensure transparency and security throughout the process.

The cost of storage is determined based on various factors. The yearly growth rate for gold is set at 0.7%, while platinum and palladium have growth rates of 0.6% and 0.7% per year, respectively. The average annual growth rate for silver production is 0.8%.

These are the base rates and HAA mentions that large accounts may qualify for discounts. Clients who invest over $1,000,000 may benefit from lower rates, with gold storage costing as little as 0.5% per year.

Clients utilizing HAA's storage options are subject to a minimum monthly fee of $5 per account. However, this fee is waived if they opt for HAA's automatic investing account, MetalStream. HAA ensures that clients fully own their precious metals and provides convenient online access to their accounts.

Clients can request the delivery of their stored precious metals or sell them for cash.

Pricing Information

Hard Assets Alliance operates as a marketplace for precious metals rather than a dealer. This means that when investing in precious metals through Hard Assets Alliance, you have the opportunity to choose from a variety of different vendors.

These vendors compete with each other by bidding on specific orders and offering competitive prices to attract customers. However, it is essential to note that the prices on Hard Assets Alliance may not necessarily be the lowest available.

Precious metals have a well-established base price, but dealers require a profit margin, reflected in the markup they apply to the costs. While dealers in the market may coordinate to establish a floor price for transactions, the prices in the Hard Assets Alliance marketplace may not directly reflect the prevailing market rates.

Nevertheless, the competition among bids helps to keep the markup relatively low, although it may not be as low as desired.

The markup you can expect to pay on each ounce of metal purchased through Hard Assets Alliance is approximately 3% above the spot price. It's important to note that this premium decreases as the quantity of metal purchased increases. While this markup is not the highest you will find among dealers, it is also not the lowest.

It is crucial to consider that the actual cost of precious metals transactions goes beyond the initial cash outlay. If you have an IRA, you may need to pay annual fees for maintenance and storage. Therefore, it is advisable to calculate the total cost, including any associated fees, before purchasing through the Hard Assets Alliance marketplace.

Customer Complaints

While Hard Assets Alliance may seem appealing at first glance, some complaints and criticisms have been raised about the company. It is essential to consider these concerns when evaluating the firm. Here are some key issues that have been highlighted:

Lack of Transparency

Lack of Transparency

One common complaint is the lack of openness regarding the company's ownership. The fact that the owners are unknown raises concerns for some investors.

Additionally, reports suggesting ownership by other corporations have been questioned, adding to the uncertainty. This lack of transparency can deter those who value detailed information about the company they are investing in.

Complex Structure

Complex Structure

Hard Assets Alliance operates with numerous groups and systems involved in its operations. This complexity raises concerns about accountability and responsibility. If an issue were to arise, it could be challenging to pinpoint who is ultimately responsible.

The heavy reliance on external systems and partnerships also raises questions about the company's control and oversight over its operations.

Cost Considerations

Cost Considerations

While Hard Assets Alliance may appear affordable based on their listed pricing, there have been complaints about excessive shipping and handling fees and undisclosed additional costs.

This has led to a reputation for charging higher-than-expected fees, which contradicts the initial perception of affordability. These unexpected costs and lack of transparency in pricing can be frustrating for investors.

Customer Service Issues

Customer Service Issues

Customers have reported difficulties in reaching the Hard Assets Alliance customer service department. This may be attributed to the abovementioned issues of transparency and hidden costs. While initial interactions may be satisfactory, ongoing support and responsiveness can become challenging, affecting the overall customer experience.

Advantages of Hard Assets Alliance

Hard Assets Alliance offers several advantages to investors looking to engage in precious metals trading and storage. Here are the key benefits of choosing Hard Assets Alliance:

What Percentage of Your Investments Should Be in Precious Metals?

When considering investing in precious metals, it is generally recommended by investment professionals to allocate a portion of your portfolio to these alternative assets.

The specific percentage can vary depending on individual circumstances, but a standard guideline is to give between 10% and 20% of your portfolio to precious metals.

Diversification is a critical principle in investment strategy, as it helps spread risk and protect against market volatility.

Precious metals, such as gold, silver, platinum and palladium, have historically demonstrated a degree of independence from other asset classes, making them attractive as a diversification tool.

The exact allocation to precious metals within your portfolio will depend on several factors, including your financial goals, risk tolerance and investment horizon.

For example, consider allocating a more significant percentage to precious metals if you have a higher risk tolerance and a longer investment horizon. Conversely, a smaller allocation may be more appropriate if you have a lower risk tolerance or a shorter investment horizon.

It is advisable to consult with a professional investment advisor to determine the optimal allocation for your portfolio. An investment advisor can assess your financial situation, understand your investment objectives and consider your risk tolerance.

They will then provide personalized recommendations on the appropriate percentage of your portfolio to allocate to precious metals based on your unique circumstances.

Why Add Gold to Your IRA?

Including gold in IRA can provide several advantages and help safeguard your financial future. Here's why you should consider putting gold in your IRA:

How to Fund Your Precious Metals IRA

Funding a precious metals, IRA can be accomplished through various methods, providing flexibility for investors. Here are the common ways to fund a precious metals IRA:

🠲 Direct rollover: This is a tax-free transfer where funds move directly from the custodian of the existing retirement account to the precious metals IRA custodian. It does not trigger withholding tax or count as income.

🠲 Indirect rollover: With this option, you receive a distribution from your current retirement account and have 60 days to deposit the funds into the precious metals IRA. However, a 20% withholding tax may apply and if the funds are not deposited within 60 days, it may be considered a distribution subject to taxes and penalties.

Final Thoughts

Hard Assets Alliance is a reputable and government-licensed precious metals custodian that provides a range of services to its customers. With the option to have purchased metals delivered or securely stored in a facility, clients can manage their assets.

The 24/7 online access to accounts allows for convenient monitoring and selling of assets as desired.

While the company has faced some criticisms and concerns, it is essential to note that these issues do not classify it as a scam. Many customers have found value in the services provided by Hard Assets Alliance and the company operates within the bounds of government regulations.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<