Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Directed IRA, also known as Directed Trust Company, is a prominent provider of self-directed IRA accounts, catering to investors throughout the United States. In this review, we will explore this company's offerings in the IRA industry and assess its ability to assist investors in achieving their investment goals.

As the global popularity and adoption of cryptocurrencies continue to soar, it is crucial to determine whether Directed Trust Company is suitably positioned to support individuals in this evolving landscape. Let us investigate the details and evaluate Directed IRA's capabilities without further ado.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

About the Company

Directed IRA, operating under Directed Trust Company, is a reputable firm specializing in self-directed IRA accounts. Founded by tax attorneys Mat Sorensen (CEO) and Mark J. Kohler (CFO), who have widely recognized authorities in the industry, the company has been serving self-directed clients since 2005.

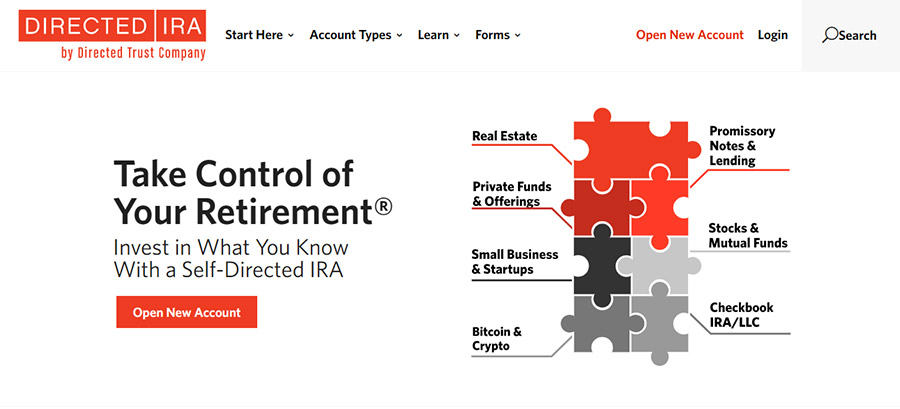

A Directed IRA's key strength is facilitating investments in many non-publicly traded assets.

Account holders can utilize their retirement plan funds to invest in various opportunities, including real estate, LLC/LP, IRA/LLCs (commonly known as checkbook control IRAs), precious metals, notes and even Bitcoin and cryptocurrencies.

This diverse investment portfolio allows individuals to explore alternative income sources within their IRA accounts.

Directed Trust Company, the parent company of Directed IRA, operates as a regulated trust company under the oversight of the Arizona Department of Insurance and Financial Institutions. This regulatory framework ensures compliance with strict capital requirements like those imposed on licensed financial institutions.

Consequently, customers can have confidence in the company's adherence to regulatory standards and commitment to providing a secure investment environment.

Moreover, it is worth noting that the officers and board of directors of Directed Trust Company personally engage in self-directed investments.

This firsthand experience positions them to understand the needs and perspectives of self-directed investors, enabling them to approach all aspects of the business from a customer-centric standpoint.

How Does Directed IRA Work

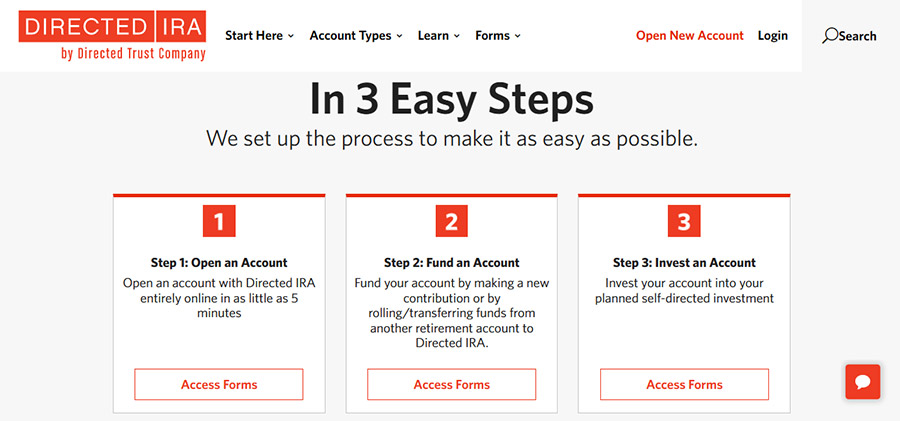

Getting started with a Directed IRA is a straightforward process designed to assist individuals in achieving their investment goals. Two primary ways to initiate the process are to complete the relevant form on the company's official website or directly contact their customer support staff.

If you decide to complete the form, you can find it under the "FORMS" menu on the Directed IRA website. Select the state that corresponds to the specific service or investment opportunity you are interested in.

By filling out the form and submitting it, you will initiate the engagement process with the company. Their customer support team will then guide you through the necessary steps and provide the assistance you need to proceed with your investment.

Alternatively, you can directly contact Directed IRA's customer support staff by phone. Contact their provided phone number and a knowledgeable representative will be available to answer your questions, address your concerns and guide you through getting started.

The company's official website also offers educational materials for individuals who want to understand better Directed IRA's services and how they can assist.

Under the "LEARN" menu, you can access various resources that provide valuable information about self-directed IRAs and the investment opportunities available through Directed IRAs. Exploring these materials can better understand the company's offerings and help you make informed decisions about your investment strategy.

Directed IRA Services

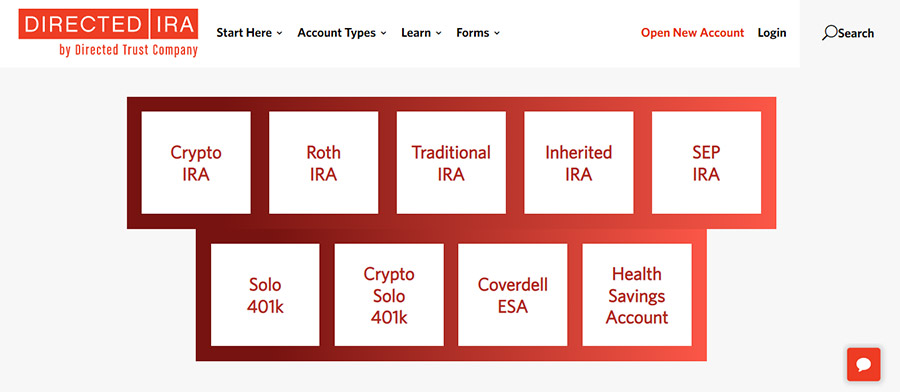

Directed Trust Company offers custodial services for individuals looking to open their Retirement Accounts (IRAs) and capitalize on various asset price increases as they approach retirement. The company provides support for several types of IRAs, including:

It is important to note that Directed Trust Company explicitly states that they do not provide due diligence on third-party investments, platforms, sponsors or service providers. They focus on delivering directed custodian services and empowering individuals to make investment decisions within the framework of self-directed IRAs.

How to Open a Cryptocurrency IRA with the Company

To open a Crypto IRA with Directed IRA, you can follow these steps:

It's important to note that there are fees associated with maintaining a Crypto IRA with a Directed Trust Company:

Required Minimum Investment

Directed Trust Company does not openly disclose minimum purchase requirements on its website for opening a Crypto IRA. However, it's advisable to consult with their customer support staff while opening a Crypto IRA to confirm if there are any minimums or specific requirements for investments.

In some cases, custodial companies may have minimum investment amounts that need to be met before making purchases within an IRA. These minimums can vary depending on the company and the type of investment being considered.

It's recommended to contact Directed Trust Company directly to ensure that you have accurate and up-to-date information regarding any potential minimum purchase requirements.

Their customer support staff will be able to provide you with the specific details and clarify any questions you may have regarding minimum purchase amounts for investments within a Crypto IRA.

Is Directed IRA a Legit Company?

Directed IRA, operated by Directed Trust Company, is generally considered a genuine and reliable company in the self-directed IRA industry. Several factors contribute to this perception:

However, conducting thorough research and considering multiple options before making financial decisions is always advisable. While Directed IRA has a good reputation, it is essential to evaluate other companies in the industry and compare their offerings, fees and customer reviews to make an informed choice that aligns with your investment goals and preferences.

Customer Reviews

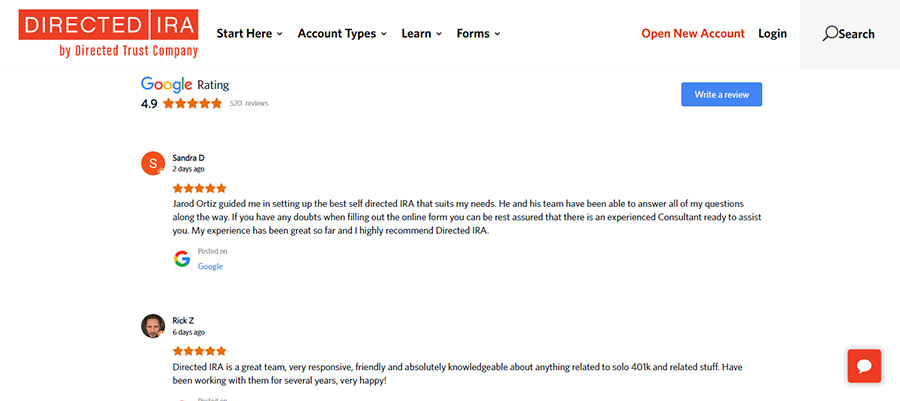

Directed IRA has limited customer reviews on popular review platforms such as Trustpilot, BCA (Better Business Bureau) and Trustlink. It's important to note that the absence of studies on these platforms doesn't necessarily indicate a negative reputation, as not all companies have a presence or seek accreditation on every review site.

Directed IRA does have a few customer reviews on Facebook, where it has received a perfect rating of 5 out of 5 stars. While these reviews provide positive feedback, it's important to consider the relatively small number of studies and the fact that they are solely on one platform.

It's advisable to consider a broader range of reviews and feedback from multiple sources when assessing the reputation and credibility of a company.

Although Directed IRA may not have an extensive presence on various review platforms, further research is recommended by seeking additional customer reviews, checking industry forums and considering feedback from other reputable sources.

This will provide a more comprehensive understanding of the experiences and opinions of customers who have used Directed IRA's services.

Advantages of Directed IRA

Directed IRA offers several benefits to its customers, including:

Whether you have questions about opening an account, making investments or managing your self-directed IRA, their customer service representatives can provide guidance and support.

The company follows strict capital requirements mandated by licensed financial institutions, which adds an extra layer of credibility and security.

Disadvantages of Directed IRA

While Directed IRA offers several advantages, it also has some potential disadvantages to consider:

This lack of transparency may require customers to contact the company directly for more information.

IRS Rules on Precious Metals IRA

The IRS has specific rules and guidelines that must be followed.

Eligible Precious Metals

The IRS allows certain types of precious metals to be held in an IRA. These include gold, silver, platinum and palladium. However, not all forms of these metals are eligible. The IRS specifies that only certain coins and bars meeting specific criteria are acceptable.

For coins, they must be produced by a recognized government mint and meet minimum purity requirements. Approved coins include American Gold Eagles, American Silver Eagles, Canadian Maple Leafs and more. Approved bars must also meet specific purity and manufacturing requirements.

Prohibited Precious Metals

Certain types of precious metals are not eligible for inclusion in an IRA. These typically include collectible coins and certain numismatic or rare coins with excessive premiums over their intrinsic value. Additionally, certain types of bullion, such as proof coins and commemorative coins, may also be excluded.

Custodial Requirement

To hold precious metals in an IRA, you must establish an account with a self-directed IRA custodian or administrator that allows for alternative investments.

These custodians facilitate investments in non-traditional assets, such as precious metals. They will handle the administrative tasks and ensure compliance with IRS regulations.

Storage and Distribution

The IRS requires that the precious metals held in an IRA be stored in a designated and approved storage facility. These facilities are typically secure vaults operated by specialized storage companies.

The metals must be physically segregated and cannot be stored at home or personally held by the IRA owner. Any distributions or sales of precious metals from the IRA must be made following IRS regulations to avoid penalties and taxes.

Contribution and Withdrawal Rules

Contributions to an IRA can be made in cash, which can then be used to purchase eligible precious metals. The IRS sets annual contribution limits for IRAs, regardless of whether the contributions are made in cash or used to acquire precious metals.

Withdrawals or distributions from the IRA, including the sale of precious metals, may be subject to taxes and penalties depending on the type of IRA (traditional or Roth) and the account owner's age.

How Do You Fund Precious Metals IRA?

Funding a Precious Metals IRA can be done through various methods.

❑ Cash Contributions

Cash contributions involve depositing funds directly into your Precious Metals IRA account. You can make regular contributions from your income or savings to purchase precious metals within the IRA. These contributions can be made annually, subject to the contribution limits set by the IRS.

The cash is then used to buy the eligible precious metals of your choice, such as gold, silver, platinum or palladium.

❑ Transfers

It transfers funds or assets from an existing IRA account to a Precious Metals IRA. This can be done without incurring any tax consequences or penalties. The transfer process typically requires you to initiate a direct transfer between the custodians or administrators of the two IRAs.

The funds or assets are transferred directly from one account to another, allowing you to retain the tax advantages of the IRA while investing in precious metals.

❑ Rollovers

A rollover is similar to a transfer but involves moving funds or assets from a qualified retirement plan into a Precious Metals IRA, such as a 401(k) or 403(b). This can be done when you change jobs, retire or otherwise become eligible to roll over your retirement plan funds.

A rollover allows you to move the funds or assets into a self-directed IRA, giving you the flexibility to invest in precious metals. It's important to note that rollovers must be completed within a specific time frame to avoid taxes and penalties.

Final Thoughts

Directed IRA is a reputable company offering required custodial services for various types of IRAs, including Crypto, Traditional and SEP IRAs. Experienced tax attorneys found the company and followed strict capital requirements set by licensed financial institutions.

Directed IRA offers multiple account types, allowing investors to choose the IRA that aligns with their investment goals and preferences. The company also provides free educational materials, which can be valuable for individuals looking to understand self-directed IRAs and investment options better.

One of the strengths of Directed IRA is its commitment to customer service and professionalism. Although there is a lack of reviews on popular platforms like Trustpilot and BBB accreditation, the positive customer reviews on Facebook indicate that the company has satisfied customers who appreciate its services.

However, it's important to note some potential drawbacks. BBB does not accredit directed IRAs and its website has limited information about funding methods for IRA accounts. Additionally, the company does not offer live chat support, which may disadvantage those seeking immediate assistance.

While a Directed IRA seems to be a viable option for individuals interested in self-directed IRAs, considering other companies is also advisable. Comparing different providers and evaluating their services, fees and customer reviews will help you decide to suit your retirement investment needs best.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<