Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

In these uncertain times, the appeal of a Precious Metals IRA has grown significantly. With government shutdowns and economic unrest resulting from government bailouts, retirement planning has become a source of anxiety for many, especially the baby boom generation.

People naturally turn to precious metals for their perceived value and reliability during challenging times. While investing always carries some risk, being well-informed and making logical decisions can help alleviate anxiety.

For conservative investors, a precious metals IRA is often seen as the best choice, whether as their primary or secondary investment vehicle. Capital Gold Group consistently ranks near the top among the companies highly regarded in this field.

Their expertise and reputation make them a trusted option for those seeking to invest in precious metals for retirement.

Recognizing that a Precious Metals IRA can provide stability and a hedge against economic volatility is important. By diversifying their portfolios and including assets like gold, silver, platinum and palladium, investors aim to protect their wealth during economic uncertainty.

The Capital Gold Group, with its strong track record and knowledgeable team, can assist individuals in making informed decisions to secure their financial futures.

This review will thoroughly examine Capital Gold Group, assessing its business practices, product offerings, strengths, weaknesses and suitability for investing in gold or a gold-backed IRA. We aim to help you make an informed decision by providing a balanced analysis.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

What is Capital Gold Group?

The Capital Gold Group is a well-established gold investment company operating since 2000. Headquartered in Woodland Hills, California, the company provides individuals with long-term investment options that maximize profits while safeguarding their savings from potential threats from economic crises.

At the helm of the Capital Gold Group is Jonathan Rose, who serves as the CEO. He is also known for hosting a syndicated radio show that offers insightful market analysis to listeners.

One of the key aspects of the Capital Gold Group's approach is investor education. The company strives to educate existing and potential investors about the benefits and intricacies of gold investment.

They accomplish this through various means, including their free publication called the "Definitive Gold Guide." This comprehensive guide provides valuable information about gold investment, helping individuals make informed decisions.

The Capital Gold Group also produces a weekly report called "The Guardian." This report is a reliable source of market updates and analysis, keeping investors well-informed about the latest trends and developments in the gold market.

Products Offered

Capital Gold Group offers services and products related to precious metals investments, primarily focusing on gold and silver. As an investment company, Capital Gold Group aims to assist investors in diversifying their investment portfolios by including physical gold and silver assets.

One of the key services Capital Gold Group provides is expert guidance and consultation for individuals interested in adding gold or silver to their investment holdings.

The company has a team of gold specialists who work closely with potential investors, providing information, answering their queries and helping them set up an account with CGG.

Capital Gold Group offers the advantage of storing precious metals in secure third-party depositories. This ensures that investors' gold and silver assets are safely stored in specialized facilities that store valuable metals.

By utilizing third-party depositories, CGG provides that investors' assets are held separately from the company's inventory, minimizing the risk of loss or commingling.

In addition to secure storage, Capital Gold Group also facilitates the delivery of precious metals to clients upon request.

Whether an investor wants physical possession of their gold or silver or wishes to take delivery of a portion of their holdings, CGG arranges reliable and timely delivery services. This allows investors to have flexibility and control over their precious metal assets.

Capital Gold Group aims to provide clients with a seamless and efficient experience. The company prides itself on delivering fast and reliable services, promptly meeting clients' needs.

With their team of gold specialists and a focus on customer service, CGG aims to provide a high level of support and account management to investors throughout their relationship with the company.

Customer Service

At Capital Gold Group, customer service is a priority and the company offers various communication channels to assist clients. Whether you have inquiries, need assistance with account management or require support, there are multiple ways to reach out to their customer service representatives.

One of the convenient options is contacting Capital Gold Group through email. By emailing their designated customer service address, you can communicate your questions or concerns and expect a timely response from their team.

This allows for asynchronous communication, enabling you to reach out at your convenience.

Capital Gold Group provides a live online chat feature on their website for real-time assistance. This allows you to converse with a customer service representative through instant messaging directly. You can discuss your queries, seek guidance or address account-related issues quickly and interactively.

Capital Gold Group offers a toll-free phone number you can call during business hours if you prefer voice communication. This allows for direct and personal interaction with their customer service team. They can provide immediate assistance, answer your questions and guide you through the necessary processes.

Additionally, even outside regular business hours, Capital Gold Group ensures someone is always available to address your concerns. Live operators are accessible 24/7 to take your message, ensuring that your inquiries are captured and forwarded to the appropriate department.

Although the company is closed on major holidays, this continuous availability demonstrates its commitment to customer support.

Fees and Pricing

Capital Gold Group does not disclose specific prices and fees on its website. To obtain detailed information about their prices and fees, it is necessary to contact them directly.

They can provide comprehensive details regarding the costs associated with their services, including any applicable fees for purchasing, storing or selling precious metals.

It is important to note that when investing in an Individual Retirement Account (IRA) with Capital Gold Group or any other company, the fees can vary depending on the custodian you choose to work with. The custodian is responsible for administering and safeguarding the assets held within the IRA.

Each custodian may have their fee structure, including setup fees, administrative fees, storage fees and other associated charges.

When considering an IRA investment, gathering information from different custodians and comparing their fee structures is advisable. This will help you evaluate the overall costs and select a custodian that aligns with your investment objectives and budget.

It is also recommended to consult with a financial advisor or IRA specialist who can guide selecting a custodian and understanding the associated fees.

Reviews and Ratings

Capital Gold Group's ratings and reviews exhibit a range of feedback, including both positive and negative experiences. While some reviews are favorable, certain aspects raise concerns among potential investors.

The company has an F rating with the Better Business Bureau (BBB) and is not accredited by the organization. This rating is indicative of issues and complaints raised by consumers that have not been satisfactorily resolved.

However, it is worth noting that the F rating is based on a limited number of reviews (11 in this case), which may not provide a comprehensive representation of all customer experiences.

On the other hand, Capital Gold Group has received an AAA rating from the Business Consumer Alliance (BCA) based on a single review. This positive rating suggests that at least one customer had a satisfactory experience with the company according to the BCA's evaluation criteria.

The RipOff Report platform has recorded ten reports related to Capital Gold Group. These reports raise concerns, as they may indicate instances where customers felt dissatisfied or encountered issues with the company's services.

It is important to review the details and nature of these reports to understand the specific complaints and circumstances involved.

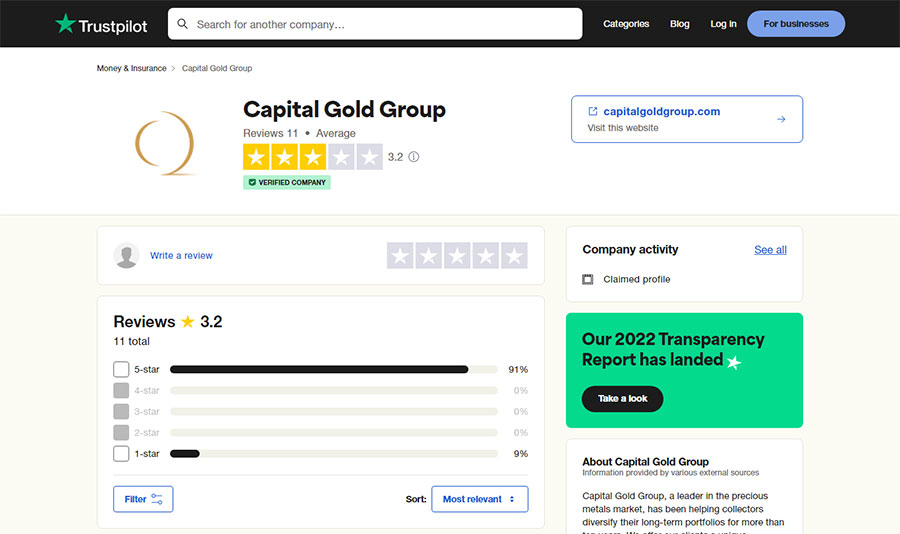

Reviews on Trustpilot, Yelp and Trustlink showcase mixed feedback. Trustpilot, for instance, assigns Capital Gold Group a rating of 3.2 out of 5 stars based on 11 reviews. This indicates that while some customers had positive experiences, some expressed dissatisfaction.

Similarly, Yelp displays a 4.5-star rating based on ten reviews, suggesting a generally positive impression among a small number of reviewers. Trustlink presents a higher 4.5-star rating, with many reviews (206) contributing to this score.

Advantages of Capital Gold Group

Before making any investment decisions, it is important to consider the key features and positive aspects of Capital Gold Group. Here are some notable advantages of the company:

Disadvantages of Capital Gold Group

While Capital Gold Group offers notable features, it is important to consider the potential disadvantages of investing with the company. Here are some points to consider:

Why Invest in Gold IRA?

A gold IRA can offer several benefits and be valuable to a diversified investment portfolio.

❑ Diversification

Gold can act as a hedge against economic uncertainty and market volatility. Including gold in your portfolio through a gold IRA can help diversify your investments beyond traditional stocks, bonds and real estate.

Gold's performance has shown a historical tendency to move independently of other asset classes, making it a potentially stabilizing force in market turbulence.

❑ Inflation Hedge

Gold is often viewed as a hedge against inflation. When inflation rises, the value of fiat currencies tends to decrease, while the price of gold may increase. By holding physical gold or gold-related assets within an IRA, investors can protect their purchasing power and preserve wealth over the long term.

❑ Potential for Capital Appreciation

Over the years, the price of gold has demonstrated the potential for long-term capital appreciation. While there can be fluctuations in the short term, gold has historically maintained its value over the long run. By investing in a gold IRA, individuals can participate in the potential growth of gold prices.

❑ Portfolio Protection

Gold's status as a tangible and finite asset can provide portfolio protection. Gold has often been a haven investment in economic instability or geopolitical uncertainty. Holding physical gold within an IRA can offer security and serve as a potential store of value during turbulent times.

❑ Tax Advantages

By investing in a gold IRA, individuals can enjoy potential tax advantages. Traditional gold IRAs offer tax-deferred growth, meaning that investors can postpone paying taxes on their investment gains until they withdraw during retirement. Roth gold IRAs allow tax-free growth and withdrawals, assuming certain conditions are met.

Final Thoughts

While Capital Gold Group is not considered a scam and has provided legitimate products and services, it is important to acknowledge the significant number of customer complaints and concerns. Additionally, there appears to be confusion surrounding the company's current brand and website.

Given these factors, exercising caution and exploring alternative options concerning precious metal dealers is understandable. You can find companies with a stronger track record, better customer satisfaction ratings and clearer branding and online presence by considering other reputable dealers.

When choosing a precious metal dealer, it is advisable to conduct thorough research and consider factors such as customer reviews, industry reputation, pricing transparency, customer service quality, storage options and overall trustworthiness.

Comparing multiple dealers and gathering information from reliable sources can help you make a more informed decision and select a dealer that aligns with your investment goals and preferences.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<