Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

With extensive experience in the industry, Bishop Gold Group is a viable option for individuals looking to invest in precious metals.

The company prioritizes building healthier and more informed relationships with its clients, ensuring they have the necessary knowledge to make sound investment decisions. This approach instills confidence in clients and enables them to reap the benefits of diversifying their portfolios.

Bishop Gold Group has gained recognition as a reliable platform due to its commitment to acting in the best interests of its clients. Rather than treating clients as mere business associates, they are regarded as valued team members. This fosters a strong and mutually beneficial connection, enhancing teamwork and overall profitability.

Whether you are a beginner or an intermediate investor in the precious metals industry, Bishop Gold Group stands out as one of the top options. Their dedication to client satisfaction and expertise in the field make them a reliable partner for long-term investment success.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

About Bishop Gold Group

Bishop Gold Group is a premier platform for individuals seeking to invest in gold and other precious metals in the United States. Headquartered in Los Angeles, California, the company prioritizes diversifying individual savings to ensure financial security for its clients and their beneficiaries.

With a steadfast commitment to personalized investment advice and support, Bishop Gold Group has cultivated a thriving community of investors eager to explore the potential of gold, silver, platinum and palladium.

The firm has garnered a reputable standing within the financial industry owing to its unwavering dedication to exceptional customer service.

Bishop Gold Group boasts extensive investment opportunities and provides tailored investment advice to cater to its clients' unique needs and goals. Specializing in assisting individuals in diversifying their portfolios and building wealth through precious metals, the company offers complimentary educational seminars held across the United States.

Furthermore, as a representative of First Gold Bank, Bishop Gold Group caters to investors seeking secure storage solutions for their precious metals, both locally and internationally.

A key aspect of Bishop Gold Group's approach revolves around advising customers to develop a well-defined investment strategy. By understanding their client's financial objectives, the firm empowers them to make informed decisions regarding allocating their investments across various markets.

Why Invest with Bishop Gold Group?

Investing with Bishop Gold Group offers numerous compelling reasons to consider them a trusted partner in your investment journey.

Established Expertise

With extensive roots and experience in the financial industry, Bishop Gold Group brings a wealth of knowledge and expertise to the table. Their seasoned professionals deeply understand the market dynamics and can provide valuable insights to guide investment decisions.

Trust and Reliability

Bishop Gold Group has built a strong reputation for fostering trust and reliability among its clients. They prioritize building long-term relationships and act in the best interests of their clients. This commitment to trustworthiness sets them apart as reliable partner in your investment endeavors.

Diversification Strategies

Bishop Gold Group understands the importance of diversifying your investment portfolio. Investing in gold and other precious metals helps mitigate risk and protect your wealth against market volatility.

Their experts can guide you in adopting effective diversification strategies tailored to your financial goals.

Gold IRA Services

Bishop Gold Group offers a streamlined process for setting up a gold IRA, providing a secure and tax-advantaged solution for your retirement savings. Incorporating gold and other precious metals into your retirement portfolio allows you to enjoy the potential for tax-free growth and safeguard your financial future.

Tax Expertise

The team at Bishop Gold Group comprises experts in tax law who can ensure that your investment aligns with applicable tax legislation. By leveraging their knowledge, they can help you navigate the complexities of taxation and optimize your investment strategy accordingly.

This tax advantage strategy can enhance the overall returns on your investment and benefit you and your family in the long run.

Products and Services

Bishop Gold Group offers a comprehensive range of products and services to cater to clients' investment needs in precious metals.

Gold Prices

Bishop Gold Group provides clients with up-to-date information on historical trends and current changes in gold prices. By offering live gold prices and historical gold price data, clients can gain valuable insights for making well-informed investment decisions.

The availability of annual figures spanning the past 48 years allows clients to assess the potential profits and capitalize on the current market's rising prices.

Investing in Gold Portfolios

Bishop Gold Group assists clients in creating new gold-based IRAs or rolling over their existing IRAs to include gold or other precious metals. By diversifying financial portfolios, clients can optimize their investment benefits in the gold market.

The company offers portfolio management and risk management practices to ensure that individual retirement accounts or rollovers into gold-based IRAs are implemented with minimal volatility, maximizing potential returns.

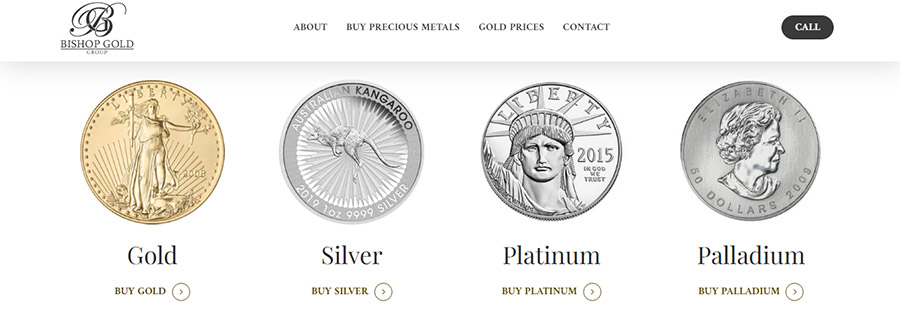

Buying and Investing in Precious Metals

Bishop Gold Group enables clients to purchase and invest in various gold and silver coins, considering nationality and value. The options range from highly valued American Gold coins to South African Ones.

Additionally, clients can acquire gold, silver, platinum and palladium bars and rounds for purchase and investment from their retirement savings. This allows for diverse precious metals to suit individual investment preferences.

Setting Up a Gold IRA with Bishop Gold Group

Setting up a Gold IRA with Bishop Gold Group involves a comprehensive process prioritizing the security and diversification of your retirement savings.

Initial Consultation

You begin by scheduling an initial consultation with Bishop Gold Group. During this consultation, their experienced advisors will assess your financial goals, retirement timeline and risk tolerance. They will provide personalized guidance and recommendations tailored to your specific needs.

Selecting a Self-Directed Custodian

Bishop Gold Group will recommend reputable self-directed IRA custodians who specialize in precious metals. These custodians have expertise handling gold IRAs and will help you set up a new self-directed IRA account.

Transfer of Funds

When you choose a custodian, you will transfer funds from your existing IRA or retirement account to the new self-directed IRA. Bishop Gold Group will provide guidance and support through this process to ensure a smooth and seamless transfer.

Precious Metal Selection

After your funds have been successfully transferred, Bishop Gold Group will help you select the precious metals that align with your investment goals. They offer many options, including gold coins, silver bars, platinum rounds and more.

Their knowledgeable advisors will provide insights into market trends and historical performance to help you make informed decisions.

Purchasing and Storage

Once you have selected, Bishop Gold Group will handle the purchasing process on your behalf.

They work with trusted partners and dealers to acquire precious metals competitively. The metals will then be securely stored in highly reputable depositories, such as Delaware Depository or Brink's Global Service Depository, which offer advanced security measures and insurance coverage for your investments.

Ongoing Portfolio Management

Bishop Gold Group believes in maintaining a long-term relationship with its clients. They provide regular updates on market conditions, gold prices and other relevant information to assist you in staying informed and making strategic decisions regarding your Gold IRA.

Their experienced team of professionals can answer any questions and provide ongoing support as you monitor and manage your portfolio.

Bishop Gold Group Reviews

Bishop Gold Group has garnered positive reviews and ratings from various reputable sources, reflecting its clients' satisfaction and the quality of its financial services.

Why Invest in Gold?

Investing in gold offers several compelling reasons and benefits, making it an attractive option.

Tangible and Finite Asset

Gold is a physical asset that holds intrinsic value. Unlike fiat currencies that can be printed endlessly, gold has a limited supply and cannot be created or destroyed. This inherent scarcity contributes to its value and makes it a reliable store of wealth.

Protection Against Inflation

Gold serves as a hedge against inflation. When the value of fiat currencies depreciates due to excessive money printing or economic instability, gold maintains its purchasing power. It has a long history of preserving wealth and acting as a haven during economic uncertainty.

Geopolitical Stability

Gold has proven to withstand geopolitical unrest and economic turmoil. In political instability or conflicts, currencies may lose value, but gold retains its worth. This stability makes gold an attractive investment option for those seeking to safeguard their assets during uncertain times.

Historical Value and Durability

Gold has been valued throughout human history for its durability, malleability and scarcity. It has been utilized as a store of value for centuries and a medium of exchange it's longevity as a precious metal and consistent demand contribute to its enduring value.

Diversification and Portfolio Protection

Including gold in an investment portfolio helps diversify risk. Gold's performance often moves independently of traditional financial assets such as stocks and bonds, providing a hedge against market volatility. By assigning a portion of one's portfolio to gold, investors can reduce overall risk and potentially enhance long-term returns.

Emerging Trends in the Financial Market

As investors recognize their potential benefits, gold and other precious metals have gained popularity in investment plans. As the financial market evolves, more individuals and institutions are diversifying their savings by including gold and other precious metals in their investment strategies.

Which Precious Metals Are Allowed in IRA?

Investors looking to include precious metals in their IRAs should be aware of the specific requirements set by the Internal Revenue Service (IRS). Here are more details on the precious metals allowed in an IRA:

It's important to note that not all varieties of precious metals are allowed in an IRA. Collectible or numismatic coins, such as rare or commemorative coins, are generally not permitted. The focus is on investment-grade bullion coins and bars.

Additionally, the precious metals held in an IRA must be physically possessed by a trustee or custodian. They cannot be directly held or stored by the account holder. Approved custodians or trustees are responsible for securely storing the metals on behalf of the investor.

The IRS also sets weight requirements for the precious metals in an IRA. For example, gold coins must weigh at least one-tenth of an ounce, while silver coins must weigh at least one ounce. Specific weight requirements also apply to platinum and palladium coins or bars.

It's pivotal to stay informed about any updates or changes to IRS guidelines regarding precious metals in an IRA. Consulting with a professional specializing in self-directed IRAs or precious metal investments can provide valuable guidance and ensure compliance with IRS regulations.

How to Fund Your Precious Metals IRA

Funding a precious metals, IRA provides investors with a secure and tangible asset to protect their retirement savings. Here are the various methods to fund a precious metals IRA, along with important considerations

Rollover

Transfers

Transferring funds from one IRA to another is a convenient and tax-free process. The transfer is made directly between the custodians of the existing IRA and the precious metals IRA. There are no limitations on the number of transfers that can be made, allowing flexibility in managing your retirement savings.

Cash Contributions

Account owners can make cash contributions to their precious metals IRA. However, adhering to the annual contribution limits the IRS sets is essential.

For the tax year 2023, individuals under 50 can contribute up to $6,500, while individuals over 50 can contribute up to $7,500. It is advisable to stay up to date with the current IRS guidelines since these limits may be subject to change,

Working with a reputable IRA custodian or a precious metals specialist is recommended when funding a precious metals IRA. They can provide expert guidance and ensure compliance with IRS regulations throughout the funding process. These professionals can also assist in selecting the most suitable precious metals for your investment objectives and help you navigate any administrative requirements.

Which IRA Account Types Can Hold in Precious Metals?

Precious metals can be held in various types of Individual Retirement Accounts (IRA), including the traditional IRA, Roth IRA and SEP IRA. Each IRA type offers distinct advantages and considerations for holding precious metals.

Individuals can make pre-tax contributions in a traditional IRA, enjoying potential tax deductions. The funds in the account grow tax-deferred until retirement and distributions are taxed as regular income.

The annual contribution limit for a traditional IRA is $6,500 ($7,500 for individuals aged 50 or older). Early withdrawals may incur a 10% penalty unless qualifying exceptions apply.

Conversely, a Roth IRA accepts after-tax contributions, providing the benefit of tax-free growth and qualified tax-free distributions. The contribution limits for a Roth IRA are the same as those for a traditional IRA.

Eligibility for contributing to a Roth IRA is subject to income limits. Qualified distributions from a Roth IRA can be tax and penalty-free after meeting specific criteria.

The SEP-IRA offers a suitable option for self-employed individuals and small business owners. Contributions to a SEP IRA are tax-deductible, reducing taxable income. The contribution limit for a SEP IRA is more generous, allowing up to 25% of net earnings or $66,000 (whichever is less).

Withdrawals from a SEP IRA are subject to income tax and may face a 10% early withdrawal penalty if taken before reaching age 59 ½.

Final Thoughts

Bishop Gold Group is a legitimate precious metals company based in Los Angeles. They have a solid stature in the industry and have been providing investment services to clients for many years. While no business is perfect, there is no evidence to suggest that Bishop Gold Group is a scam.

However, exercising caution when investing and conducting your research is always important. It's advisable to thoroughly evaluate any investment opportunity, including the reputation and track record of the company you are considering.

Reading reviews, seeking advice from financial professionals and conducting due diligence can help you make an informed decision.

While Bishop Gold Group may have merits, it's essential to consider a range of options and put them aside to find the best fit for your investment goals and preferences.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<