Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

This review aims to provide insights into A-Mark Precious Metals, addressing frequently asked questions about the company. We will examine its nature, determining whether it is a legitimate gold dealer or a potential scam. Additionally, we will explore alternative gold dealers available in the market. Let's delve into these topics to offer you a comprehensive understanding.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

Who is A-Mark Precious Metals?

A-Mark Precious Metals is a reputable full-service precious metals trading firm headquartered in Santa Monica, California. Established in 1965, the company specializes in selling various precious metals, including gold, silver, platinum and palladium bullion coins and bars.

In addition to its bullion offerings, A-Mark provides various financial services, such as consignment and hedging. Greg Robert serves as the CEO of A-Mark Precious Metals, as stated in a press release published on BusinessWire.

A-Mark is a prominent player in the bullion trading industry, dealing with precious metals like gold, silver, platinum, copper and various coins and other related products. The company serves a diverse customer base, including dealers, financial institutions, sovereign mints, refiners, brokers, investors and retail customers.

As a NASDAQ-listed company, A-Mark Precious Metals has performed strongly in recent years. Over the past three years, it has outperformed the price return of the S&P 500 by 14% and the Dow Jones Precious Metal index (DJGSP) by an impressive 20% year-to-date (YTD).

The company's exceptional financial performance has been a key factor in its gains, with record revenue of $8.2 billion generated in the trailing twelve months (TTM) ending in March 2022.

Considering A-Mark's current valuation metrics, it is a value stock with significant growth potential. The company represents an attractive investment opportunity with a forward price-to-earnings (P/E) ratio of 3.83x compared to the sector median of 10.15x.

A-Mark Precious Metals Revenue Source

A-Mark Precious Metals generates revenue from multiple sources, primarily through its operating segments. The company operates in these segments.

❑ Wholesale Trading and Ancillary Services

This segment is the primary revenue source for A-Mark. It encompasses various business units, including Industrial, Coin and Bar, Trading and Finance, Storage, Logistics and Mint.

Within this segment, the company purchases and distributes precious metals from sovereign and private mints, focusing on the United States. A-Mark also holds distributorships with renowned sovereign mints from countries such as Australia, Austria, Canada, China, Mexico, South Africa and the United Kingdom.

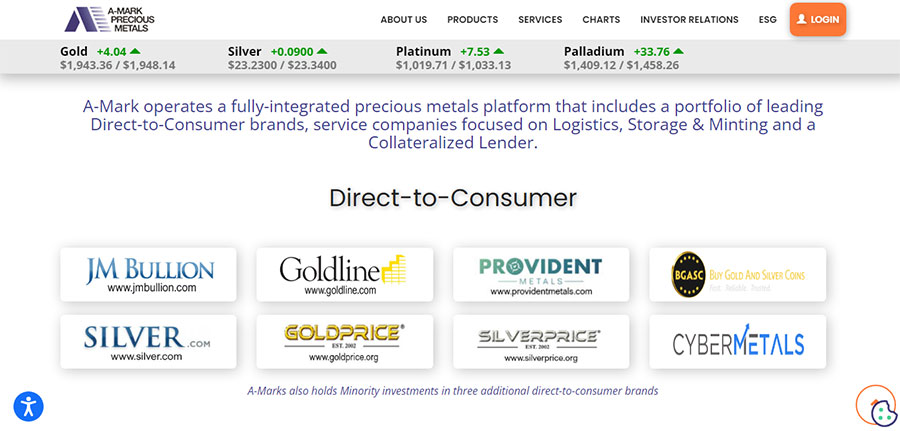

❑ E-Commerce (Direct to Consumer)

A-Mark's subsidiaries, JM Bullion and Goldline play a significant role in this segment. They engage in direct-to-consumer e-commerce operations, offering retail customers a wide range of precious metal products.

The company has strategically focused on expanding its retail presence and digitizing precious metal bars through e-commerce acquisitions. This sector has become a core focus for A-Mark in recent years.

❑ Secured Lending

A-Mark has two subsidiaries dedicated to secured lending activities. These subsidiaries originate and secure loans using bullion and numismatic coins as collateral. Revenue generation in this segment primarily comes from interest income earned on the loans provided.

Geographically, A-Mark derives a significant portion of its revenue from the United States. However, the company also has international operations and partnerships, allowing it to trade and distribute precious metals globally.

Transition Towards Direct to Consumer (D2C)

Over the past five years, A-Mark, a leading precious metal company, has pursued an expansion strategy through strategic acquisitions. These acquisitions include Silver Gold Bull, JM Bullion and Goldline, all of which have contributed to the company's success.

A-Mark has achieved remarkable results by focusing on expanding its retail operations and establishing a vertically integrated precious metal platform.

JM Bullion, an e-commerce retailer specializing in precious metals, has been a key driver of A-Mark's recent growth. JM Bullion operates five websites, each catering to specific niches in the precious metals market.

Its success has propelled A-Mark's upward trajectory, earning the company recognition as the 40th fastest-growing privately held company in the United States, according to Inc magazine's 2016 list.

A-Mark's aggressive approach has significantly increased the contribution of its direct-to-consumer (D2C) segment to overall revenue. In the first quarter of 2021, D2C accounted for approximately 5% of total revenue.

However, due to the successful integration of JM Bullion and favorable market conditions, this figure surged to over 27% in the first quarter of 2022.

The COVID-19 pandemic and subsequent surge in inflation and gold prices have further bolstered A-Mark's ascent in the precious metals industry. These macroeconomic factors have driven increased demand for precious metals, positioning A-Mark to capitalize on the growing market.

With its expanded customer base and diversified online presence, A-Mark has successfully tapped into the rising trend of consumers purchasing precious metals directly through e-commerce channels.

By leveraging its acquired subsidiaries' expertise and established online platforms, A-Mark has transformed into a powerhouse in the direct-to-consumer precious metal market.

The company's comprehensive portfolio of separately branded websites targeting specific market segments has allowed it to reach a wider customer base and cater to diverse investor preferences.

This strategic expansion into the D2C segment has driven significant revenue growth and positioned A-Mark as a prominent player in the evolving landscape of precious metal retail.

Looking ahead, A-Mark's focus on its direct-to-consumer operations, supported by its established online platforms, acquisitions and industry expertise, is expected to drive continued success.

The company's ability to adapt to changing market dynamics and capitalize on emerging opportunities underscores its commitment to providing customers with seamless and convenient access to precious metals through its digital channels.

Reviews, Rating and Complaints

In today's contemporary world, where more than 90% of potential clients rely on online reviews and over 80% of online users trust these reviews as much as personal recommendations, the importance of reviewing a company cannot be understated.

Although the company has an excellent profile, the online reviews and ratings from trusted review platforms paint a different picture regarding A-Mark Precious Metals.

While A-Mark Precious Metals has received a 5-star rating on Yelp and a 4.5-star rating on Glassdoor, it is worth noting that several major review sites have not reviewed the company.

These include Trustpilot, Better Business Bureau, Trustlink, Ripoff Report, Pissed Consumer, Review Opedia and CitySearch. The absence of ratings and reviews from these prominent review platforms is a cause for concern.

A zero rating or no reviews from nearly 80% of these significant review sites raises a red flag. It is important to consider that A-Mark's competitors in the precious metals industry typically have numerous online reviews from real users. Additionally, many of these businesses have not been in operation for as long as A-Mark has.

While it may be tempting to downplay the significance of these missing reviews, it is crucial to recognize that online reviews serve as a valuable source of information for potential customers. They offer insights into the experiences of others who have engaged with the company's products or services.

The absence of reviews from reputable sources may raise doubts about A-Mark Precious Metals' customer satisfaction, reliability and transparency.

In an industry where trust and credibility are paramount, potential customers often rely on the experiences shared by others to inform their decisions. The scarcity of online reviews for A-Mark Precious Metals on major review platforms may lead some individuals to question the company's reputation and overall customer satisfaction.

Considering the importance of online reviews and the lack thereof for A-Mark Precious Metals on prominent review sites, individuals should exercise caution and conduct further research before engaging with the company.

Exploring alternative sources of information, seeking personal recommendations or contacting the company directly for references or testimonials could provide a more comprehensive understanding of the company's performance and customer satisfaction levels.

Pros of A-Mark Precious Metals

Cons of A-Mark Precious Metals

Final Thoughts

A-Mark Precious Metals is a legitimate company operating in the precious metals industry for over five decades. While it has certain strengths and advantages, it is important to consider the overall balance of pros and cons before making an investment decision.

Considering the abovementioned factors, it would be prudent for potential investors to approach A-Mark cautiously. While the company is legitimate and has a long history in the industry, the existing cons may raise skepticism and warrant further due diligence.

Conducting thorough research, seeking advice from financial professionals and evaluating individual investment goals and risk tolerance are essential steps before making a final decision.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<