Supply and demand dynamics play a crucial role in the stock market, influencing stock prices and driving market movements. Understanding these dynamics is essential for investors and traders looking to make informed decisions.

Supply and demand in the context of the stock market refer to the availability of shares for sale (supply) and the desire of investors to buy those shares (demand). The interplay between supply and demand directly affects stock prices.

The supply of stocks increases when investors are willing to sell their shares, either to take profits or exit an investment. Conversely, demand increases when investors are interested in buying stocks, often driven by expectations of positive returns. When supply exceeds demand, stock prices tend to decrease. On the other hand, when demand surpasses supply, stock prices tend to rise.

Several factors impact supply and demand dynamics in the stock market. Economic factors such as interest rates, economic growth, and inflation can influence investor sentiment and, in turn, supply and demand. Company-specific factors, such as financial performance and news events, also impact supply and demand for a particular stock. Market sentiment and investor behavior, driven by emotions like fear or greed, can significantly influence supply and demand dynamics.

The impact of supply and demand on stock prices can be significant. When there is excess supply of shares in the market, prices tend to decline as sellers compete to find buyers. Conversely, when there is excess demand, prices can soar as buyers compete for a limited supply of shares.

Various strategies can be employed to analyze supply and demand in the stock market. Technical analysis focuses on studying price charts and market trends to identify patterns that indicate changes in supply and demand. Fundamental analysis involves evaluating a company’s financial health and future prospects to assess supply and demand dynamics. Sentiment analysis involves gauging investor sentiment through surveys, news sentiment, and social media to capture shifts in supply and demand.

Market makers, who facilitate trading by providing liquidity, also play a role in supply and demand dynamics. They act as intermediaries between buyers and sellers, ensuring that there is always someone willing to buy or sell shares, contributing to price stability.

Understanding Supply and Demand Dynamics in Stock Market

Photo Credits: Www.Mfea.Com by Austin Lopez

Understanding supply and demand dynamics in the stock market is essential. Here are some key points to consider:

1. Supply and demand play a crucial role in determining stock prices. When there is high demand and limited supply for a specific stock, its price tends to rise. Conversely, when there is low demand and a large supply of shares, prices can decrease.

2. Various factors influence the supply side, including initial public offerings (IPOs), stock splits, and share repurchases. These actions can either increase or decrease the number of available shares in the market.

3. On the other hand, demand is influenced by factors such as a company’s performance, investor sentiment, economic conditions, and overall market trends.

4. When investors have a firm grasp of supply and demand dynamics, they can make informed decisions and even predict future price movements.

Fact: The occurrence of the COVID-19 pandemic in 2020 resulted in a surge in demand for technology stocks, leading to a significant increase in their prices.

What is Supply in the Context of Stock Market?

Supply in the context of the stock market refers to the number of shares of a particular stock that are available for purchase. It represents the willingness of shareholders to sell their shares at a given price. The supply of a stock can be influenced by factors such as initial public offerings, secondary offerings, and shareholder behavior. Changes in supply can have an impact on stock prices. For example, if there is an increase in supply due to an influx of shares being sold, it can lead to a decrease in stock prices. Conversely, a decrease in supply can create a higher demand, potentially increasing stock prices. Understanding supply dynamics is crucial for investors to make informed decisions about buying or selling stocks.

What is Demand in the Context of Stock Market?

In the context of the stock market, demand refers to the level of interest or desire for a particular stock. It represents the number of buyers willing to purchase a stock at a given price. What is Demand in the Context of Stock Market? The demand for a stock is influenced by various factors such as the company’s financial performance, market trends, investor sentiment, and economic conditions. An increase in demand typically leads to a rise in stock prices, as buyers compete to acquire the stock. On the other hand, a decrease in demand can result in lower stock prices, as sellers outnumber buyers. Understanding demand is crucial for investors to make informed decisions and analyze market conditions.

How Does Changes in Supply Influence Stock Prices?

How Does Changes in Supply Influence Stock Prices?

Understanding and analyzing changes in supply play a significant role in influencing stock prices. When there are changes in the supply of a particular stock, it can have a direct impact on the stock prices. If the supply of a stock increases, it suggests that there are more shares available in the market. This surplus in supply can lead to a decrease in the stock price since it indicates a lack of demand. On the other hand, if the supply of a stock decreases, it implies that there are fewer shares available. This scarcity can potentially increase the demand for the stock and drive up its price. Investors need to consider these factors and carefully analyze changes in supply to make informed decisions and anticipate potential price movements in the stock market.

How Does Changes in Demand Influence Stock Prices?

How Does Changes in Demand Influence Stock Prices?

Demand plays a significant role in determining the prices of stocks. When there is an increase in demand for a specific stock, its price tends to rise. This occurs because more investors become willing to buy the stock, consequently driving up its value. On the other hand, a decrease in demand can lead to a decline in stock prices as there are more sellers than buyers. Several factors can influence demand, including positive company news, strong financial performance, and favorable market sentiment. By understanding these factors and monitoring changes in demand, investors can make informed decisions and potentially profit from stock price movements.

How Does Supply and Demand Affect Stock Prices?

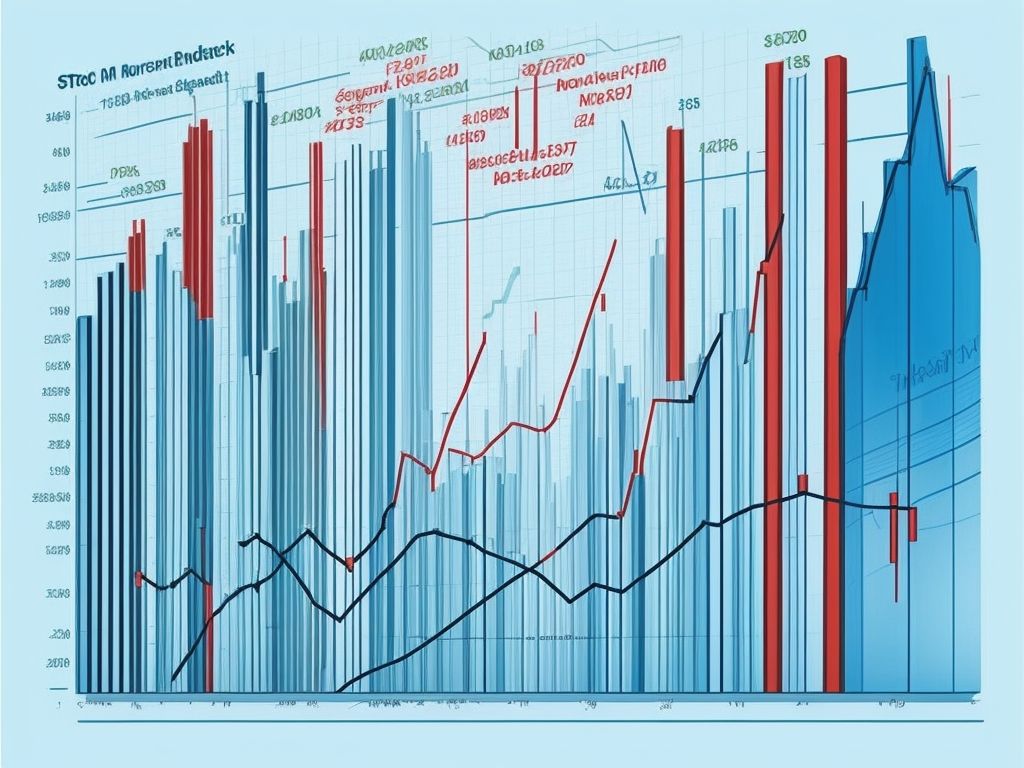

Photo Credits: Www.Mfea.Com by Noah Gonzalez

Supply and demand have a significant impact on stock prices. The price of a particular stock tends to rise when there is high demand for it, while it may drop when the demand is low. Moreover, scarcity can cause the price of a stock to increase when there is limited supply, whereas an excess supply can result in a decrease in price. It is crucial for investors to understand the interaction between supply and demand in order to make well-informed decisions. It is a fact that the Law of Supply and Demand, a fundamental concept in economics, applies to various markets, including the stock market.

Factors Affecting Supply and Demand in Stock Market

Photo Credits: Www.Mfea.Com by Vincent Harris

The factors that drive supply and demand in the stock market have a significant impact on stock prices. In this section, we’ll explore the key elements that shape these dynamics. From economic factors to company-specific influences and market sentiment, we’ll uncover the different forces at play. Buckle up and get ready to dive into the fascinating world of supply and demand in the stock market, where the tides of market behavior collide with the intricacies of business and finance.

Economic Factors

Economic factors play a crucial role in influencing supply and demand in the stock market. These economic factors encompass macroeconomic indicators such as GDP growth, interest rates, inflation, and unemployment rates. Additionally, industry-specific factors, including consumer demand, technological advancements, and government regulations, also impact supply and demand dynamics. Market participants diligently monitor these economic factors to make well-informed investment decisions. By analyzing economic indicators, investors can identify potential opportunities and risks in the stock market. To effectively navigate the stock market, it is essential to stay updated on economic trends and understand their impact on supply and demand. Successful investors consider economic factors in conjunction with other analytical methods to make informed investment choices.

Company-Specific Factors

Company-specific factors, also known as company-specific variables, play a crucial and significant role in determining the supply and demand dynamics in the stock market. These factors encompass a wide range of variables, including but not limited to the financial performance of the company, the competency of its management team, its competitive position in the market, and its growth prospects. It is worth highlighting that these factors are unique to each company and can greatly influence the demand for and supply of its stock.

When a company demonstrates positive company-specific factors, such as impressive earnings growth or a successful launch of a new product, it tends to generate higher demand for its stock. The increase in demand inevitably contributes to an upward movement in its stock price. On the other hand, negative company-specific factors, such as poor financial performance or the emergence of unfavorable news, often result in a decrease in demand for the company’s stock. Consequently, the stock price may experience a decline.

For investors seeking to make informed decisions and accurately assess the impact of supply and demand on stock prices, it is imperative to understand and carefully analyze these company-specific factors. By doing so, investors can gain valuable insights into the potential future direction of stock prices and adjust their investment strategies accordingly.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior play a crucial role in shaping supply and demand dynamics in the stock market. Market sentiment refers to the overall attitude or emotions of investors towards a particular stock or the market as a whole. Positive sentiment can boost demand for a stock, leading to an increase in its price. Conversely, negative sentiment can dampen demand, causing the stock price to decline. Investor behavior, such as buying or selling decisions based on market sentiment, further affects supply and demand dynamics. For example, if investors perceive a stock as undervalued, they may increase demand by buying more shares. A real-life example of market sentiment influencing stock prices is the GameStop stock rally in January 2021, where a group of retail investors drove up the price through coordinated buying, fueled by positive sentiment and social media influence.

Impact of Supply and Demand on Stock Price Movements

Photo Credits: Www.Mfea.Com by Christopher Harris

As we dive into the impact of supply and demand on stock price movements, we unveil the intriguing effects that excess supply and demand can have on stock prices. Discover how an abundance of supply can influence the stock market, and how skyrocketing demand can shake up the prices. Brace yourself for an exploration of the fascinating interplay between supply, demand, and the ever-changing world of stock trading.

Effects of Excess Supply on Stock Prices

When there is an excess supply of stocks in the market, it typically leads to a decrease in stock prices. This is because the effects of excess supply on stock prices are evident. An abundance of supply indicates that there are more sellers than buyers, resulting in downward pressure on prices. The effects of excess supply on stock prices can occur due to various factors such as a decrease in demand for a particular stock, an increase in the number of shares available for trading, or negative news about a company. Therefore, investors should carefully monitor the effects of excess supply on stock prices, as well as the supply and demand dynamics, to make informed decisions and avoid potential losses.

Effects of Excess Demand on Stock Prices

Excess demand in the stock market can have significant effects on stock prices. When there is higher demand for a particular stock than there is available supply, it creates a situation where buyers are willing to pay higher prices to acquire the shares. This increased demand can lead to an upward pressure on stock prices, causing them to rise. The scarcity of the stock makes it more valuable, and investors may compete with each other to buy it, driving the prices higher. This can be seen in the example of Tesla’s stock, where the effects of excess demand from investors have driven up its price significantly in recent years.

Strategies for Analyzing Supply and Demand in Stock Market

Photo Credits: Www.Mfea.Com by Henry Johnson

Get ready to dive into the world of stock market analysis! In this section, we’ll explore three powerful strategies for understanding the intricate dance between supply and demand in the stock market. We’ll uncover the secrets behind technical analysis, fundamental analysis, and sentiment analysis. Whether you’re a seasoned investor or just starting out, these strategies will equip you with valuable insights to make informed decisions and navigate the ever-changing rhythms of the stock market. Let’s get started!

Technical Analysis

Technical analysis, also known as TA, is a widely used method employed by traders to forecast stock price changes based on historical market data. This approach entails studying charts, patterns, along with utilizing indicators and oscillators to recognize potential buy or sell signals. Traders who rely on technical analysis firmly believe that examining past price and volume data can yield valuable insights into future price movements. By identifying trends and patterns, they strive to make well-informed trading decisions.

It is worth noting that technical analysis is a subjective methodology and is not foolproof. Its effectiveness depends on individual interpretation and assumptions. However, it can still serve as a valuable tool for investors seeking to gain insights into market trends. On a related note, it is interesting to mention that technical analysis is widely embraced by day traders and short-term investors to identify short-term price fluctuations.

Fundamental Analysis

Fundamental Analysis is a crucial method used to evaluate the intrinsic value of a stock. It involves thoroughly analyzing a company’s financial statements, management, current industry trends, and economic factors to determine the stock’s true worth. One essential aspect of Fundamental Analysis is examining key financial ratios, including price-to-earnings (P/E), earnings per share (EPS), and return on equity (ROE). These ratios offer valuable insights into the company’s profitability, growth potential, and overall financial health. By conducting a comprehensive Fundamental Analysis, investors can make well-informed decisions about which stocks to buy, sell, or hold based on their long-term investment objectives.

Sentiment Analysis

Sentiment analysis is an invaluable tool for analyzing supply and demand in the stock market. It involves evaluating investor sentiment and emotions to assess market trends and make informed decisions. Here are some key points about sentiment analysis:

- Quantitative data: Sentiment analysis employs algorithms to process large volumes of data from news articles, social media, and investor sentiment surveys.

- Qualitative interpretation: It goes beyond numbers, examining qualitative factors such as positive or negative sentiment, optimism, fear, and market perception.

- Market indicators: Sentiment analysis helps identify market sentiment indicators like bullish or bearish trends that influence buying and selling decisions.

- Predictive insights: By tracking sentiment and sentiment shifts, sentiment analysis can help anticipate market moves and potential changes in supply and demand dynamics.

- Combining approaches: Sentiment analysis is most effective when combined with other analysis techniques like technical and fundamental analysis.

The Role of Market Makers in Supply and Demand

Photo Credits: Www.Mfea.Com by Noah Brown

Market makers play a crucial role in the supply and demand dynamics of stock prices. They act as intermediaries between buyers and sellers, providing liquidity to the market. Their primary duty is to continuously quote both buy and sell prices for a specific stock, ensuring that there is always a market for it. By actively participating in the market, market makers narrow the bid-ask spread, making it easier and more efficient for investors to buy or sell shares. The role of market makers is vital in the supply and demand dynamics, as they contribute to maintaining stability and liquidity in the market.

Frequently Asked Questions

How do supply and demand dynamics influence stock prices?

Supply and demand dynamics play a crucial role in determining stock prices. When there is high demand and limited supply for a particular stock, the prices tend to increase. Conversely, when there is low demand and high supply, the prices tend to decrease. Understanding these dynamics can help investors predict future price movements and make informed decisions.

What factors affect supply and demand in the stock market?

Various factors can impact supply and demand in the stock market. Factors influencing supply include the number of shares issued by a company and the willingness of shareholders to sell their holdings. On the other hand, factors affecting demand include investor sentiment, economic conditions, market trends, and external events impacting the company. Recognizing these patterns, along with considering additional market factors, can aid in predicting stock price movements.

How do positive or negative news affect stock prices?

Positive news, such as better-than-expected earnings results or favorable developments, can increase demand for a stock and drive up share prices. Conversely, negative news like poor financial performance or regulatory issues can lead to increased selling pressure and lower stock prices. These factors can significantly impact the balance between supply and demand in the market.

How do institutional investors like mutual funds and pension funds impact stock prices?

Institutional investors, such as mutual funds and pension funds, can influence stock prices due to their large trading volumes. The number and speed of their transactions can drive prices up or down. These institutions have the power to create significant buying or selling pressure in the market, affecting the balance between supply and demand for specific stocks.

What role do technical indicators play in understanding supply and demand dynamics?

Technical indicators can provide insights into supply and demand dynamics in the stock market. They help investors identify patterns and trends in stock prices, volume, and other market data. By analyzing these indicators, investors can determine whether a stock is ready to make large price moves, whether supply exceeds demand or vice versa, and make more informed decisions.

How do balance sheets and fundamental factors influence supply and demand in the stock market?

Balance sheets and fundamental factors, such as future stream of earnings, free cash flow per share, and valuation multiples, impact the desirability of owning or selling a stock. If a company surprises stock owners with low earnings, demand for the stock may decrease, leading to a change in the balance between buyers and sellers. Similarly, positive fundamental factors can increase buyer demand. These factors contribute to the supply and demand dynamics that determine stock prices in the market.