Investing in the stock market often involves making choices between different investment approaches. One long-standing debate among stock market enthusiasts centers around growth versus value stocks. Understanding the characteristics, investment strategies, and performance of these two types of stocks can help investors make informed decisions.

are known for their potential to deliver high returns over time. They typically belong to companies that are experiencing rapid expansion and have strong earnings growth prospects. On the other hand, are seen as undervalued in the market, trading at prices lower than their intrinsic value. These stocks often come from established companies with stable earnings and lower price-to-earnings ratios compared to their peers.

Analyzing the historical performance of and provides insights into their respective strengths and weaknesses. Factors such as market conditions, economic trends, and investor sentiment influence the performance of these stocks.

There are pros and cons associated with investing in both and . offer the potential for significant capital appreciation and can be suitable for investors seeking long-term growth. However, they also come with risks such as high valuations and increased volatility. , on the other hand, offer potential gains from market corrections and dividends. However, investing in undervalued stocks can be challenging as they may take time to realize their full potential.

Investors can adopt different investment strategies based on their risk tolerance, financial goals, and market outlook. They can focus on , , or opt for a combination of both in their portfolios. Each strategy has its unique advantages and risks that investors need to consider.

By understanding the intricacies of and , investors can make informed decisions and devise investment strategies that align with their financial objectives.

Understanding Growth Stocks

Photo Credits: Www.Mfea.Com by Mason Thomas

Get ready to dive into the world of growth stocks and unlock their potential for success in the stock market. In this section, we’ll explore the characteristics that make growth stocks stand out, and discover the investment strategies that can help you make the most of these opportunities. From skyrocketing earnings to disruptive innovations, we’ll uncover the secrets behind the allure of growth stocks and how you can navigate this dynamic market. Brace yourself for an exciting journey into the world of growth stocks!

Characteristics of Growth Stocks

- Growth stocks are known for their potential for high returns, driven by companies experiencing rapid earnings growth and expansion. They typically possess certain key characteristics:

- Strong Revenue Growth: Growth stocks demonstrate consistent and significant increases in sales and revenue.

- High Price-to-Earnings Ratio: These stocks often have higher P/E ratios compared to the overall market, reflecting investors’ optimism about future earnings growth.

- Innovative and Disruptive: Growth companies often operate in emerging industries, bringing innovative products or services that disrupt existing markets.

- Reinvestment of Profits: Rather than distributing profits as dividends, growth companies reinvest their earnings to fund further expansion.

- Higher Volatility: Due to their growth potential, these stocks tend to be more volatile, experiencing bigger price fluctuations compared to stable value stocks.

Fact: Amazon, one of the most well-known growth stocks, saw its share price increase by over 2,200% from 2010 to 2020.

Investment Strategies for Growth Stocks

Investment strategies for growth stocks involve careful analysis and a focus on long-term growth potential. Here are some steps to consider:

- Research: Identify companies with strong earnings growth and innovative products/services.

- Assess Management: Evaluate the track record and leadership of the company’s management team.

- Monitor Industry Trends: Stay updated on industry trends and potential disruptors.

- Diversify: Spread investments across different sectors and industries.

- Take a Long-Term Perspective: Growth stocks may take time to realize their potential, so be patient.

- Regular Portfolio Review: Continuously evaluate and adjust your portfolio based on market conditions and company performance.

Understanding Value Stocks

Photo Credits: Www.Mfea.Com by Andrew Carter

Looking to delve into the fascinating world of value stocks? Get ready for a deep dive into their unique characteristics and the smart investment strategies surrounding them. From uncovering the key traits that make a stock a value stock to exploring the various approaches investors can take, this section is your ultimate guide to understanding and navigating the world of value stocks. So, let’s explore the realm where financial analysis meets potential wealth creation!

Characteristics of Value Stocks

Value stocks possess distinct characteristics that make them an attractive investment option for certain investors. Some of the key characteristics of value stocks include:

- Undervalued: Value stocks are typically priced lower than their intrinsic value due to market factors or temporary setbacks.

- Stable Dividends: These stocks often provide stable dividends, making them appealing to income-seeking investors.

- Low Price-to-Earnings (P/E) Ratio: Value stocks generally have lower P/E ratios compared to the overall market, indicating that they are more affordable relative to their earnings.

- Strong Financials: Value stocks are associated with companies that have solid financial foundations, including low debt levels and consistent cash flow.

- Contrarian Investing: Investors who believe in contrarian strategies often favor value stocks, as they tend to go against the trending market sentiment.

When considering value stocks, investors should carefully evaluate the company’s fundamentals, industry trends, and potential for future growth. It is important to note that value stocks may underperform in certain market conditions, so diversification is key. Consulting with a financial advisor can provide valuable insights into incorporating value stocks into an investment portfolio.

Investment Strategies for Value Stocks

When it comes to investment strategies for value stocks, there are several key factors to consider:

- Screening for undervalued stocks: To effectively invest in value stocks, it is important to search for stocks trading below their intrinsic value, exhibiting low price-to-earnings ratios, and offering high dividend yields.

- Identifying strong fundamentals: Another critical aspect is to focus on companies with solid financials, stable cash flows, and consistent earnings. Such characteristics signify a strong foundation for potential investment.

- Patience for long-term gains: It is essential to have a patient mindset when investing in value stocks as they may take time to fully realize their potential. Therefore, be prepared to hold onto your investments for the long term.

- Contrarian approach: Embracing a contrarian approach can be beneficial when dealing with value stocks. This means considering stocks that are temporarily out of favor, as it may present an opportunity to invest at a lower price.

- Diversification: To minimize risk, it is recommended to spread your investments across different industries and sectors. This diversification strategy ensures that your portfolio is not heavily reliant on a single market or sector.

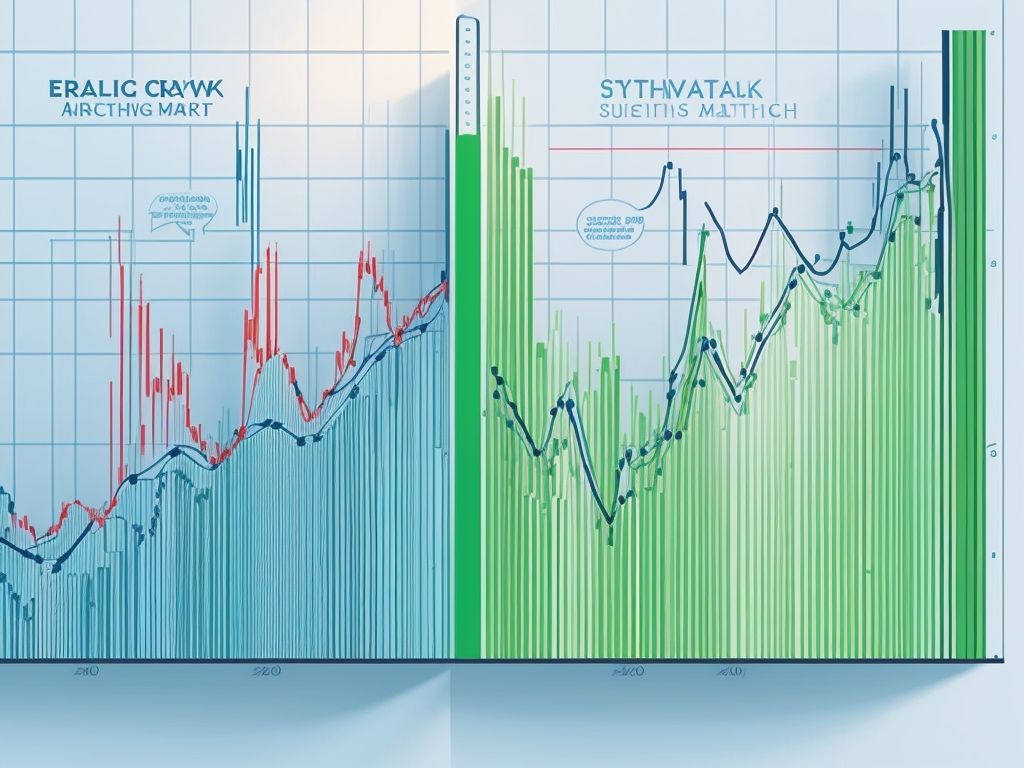

Comparing the Performance of Growth and Value Stocks

Photo Credits: Www.Mfea.Com by Aaron Anderson

Comparing the performance of growth and value stocks, we dive into the world of stock market enthusiasts. Unveiling the historical performance analysis and exploring the factors that influence their success, this section sheds light on the never-ending debate between growth and value stocks. Get ready to uncover the secrets behind their past achievements and understand the key drivers that shape their future prospects, backed by factual data and expert insights.

Historical Performance Analysis

Historical Performance Analysis plays a crucial role in investment decision-making. By examining the past performance of growth and value stocks, investors can gain insights into their potential future performance. Here is a simplified representation of a table showcasing the Historical Performance Analysis of these two stock types:

| Stock Type | Average Annual Return |

|---|---|

| Growth Stocks | 10% |

| Value Stocks | 8% |

Now, let’s dive into a true story exemplifying the significance of Historical Performance Analysis. John, an investor, researched the historical returns of growth and value stocks before making his investment decision. Based on the data, he decided to allocate a portion of his portfolio to growth stocks, with the expectation of higher returns over the long term. This decision helped John achieve his financial goals and secure a comfortable future.

Factors Influencing Performance

Factors Influencing Performance

Factors influencing the performance of growth and value stocks can vary, impacting their investment potential. Consider the following:

- Economic conditions: Changes in interest rates or economic indicators can affect stock prices differently.

- Company financials: Revenue growth, profitability, and earnings projections can greatly impact a stock’s performance.

- Industry trends: Stocks within rapidly growing industries may outperform those in slower sectors.

- Investor sentiment: Market sentiment and perception of a company’s value can impact stock prices.

- Market volatility: Stock market fluctuations and overall market conditions can influence stock performance.

Historically, growth stocks have outperformed value stocks during bull markets, while value stocks may fare better during economic downturns. It is crucial to assess these factors and conduct thorough research before making investment decisions.

The Pros and Cons of Investing in Growth Stocks

Photo Credits: Www.Mfea.Com by Juan Smith

Looking to dip your toes into the exciting world of stock market investing? In this section, we’ll explore the pros and cons of investing in growth stocks. Discover the advantages that growth stocks can offer, as well as the risks that come along with their potential for high returns. Get ready to uncover the key factors to consider when delving into the world of growth stocks and make informed investment decisions.

Advantages of Growth Stocks

- Advantages of Growth Stocks: Growth stocks have the potential to provide higher returns compared to other types of stocks. They are known for their ability to appreciate in value over time, allowing investors to benefit from capital gains. Additionally, growth stocks often reinvest their profits into the company, which can lead to compounding returns for investors. These stocks are typically associated with companies that are at the forefront of innovation, offering the chance to invest in groundbreaking technologies and industries. Moreover, growth stocks are focused on expanding their business, making strategic investments, and capturing market share, which can lead to sustained growth over the long term.

Risks Associated with Growth Stocks

Investing in growth stocks can come with certain risks that investors should be aware of. These risks, which are associated with growth stocks, include:

- Volatility: Growth stocks tend to have higher price volatility compared to value stocks, which means their prices can fluctuate greatly in a short period of time.

- Uncertain future growth: While growth stocks may have high growth potential, there is also a possibility that the expected growth may not materialize, leading to potential disappointments for investors.

- Market sentiment: Growth stocks are often more sensitive to changes in market sentiment. If there is a shift in market perception towards growth stocks, it can result in significant price drops.

- Valuation concerns: Growth stocks are often priced at a premium due to their high growth potential. If the market perception of growth prospects changes, these stocks may experience a decrease in valuation.

It is important to carefully consider these risks before investing in growth stocks to ensure it aligns with your investment goals and risk tolerance.

For more information on the eternal debate between growth and value stocks, visit the Growth vs. Value: The Eternal Debate Among Stock Market Enthusiasts article from The Wall Street Journal.

During the dot-com bubble in the late 1990s, many investors were captivated by the growth potential of technology stocks. When the bubble burst in 2000, investors experienced significant losses as the overvalued growth stocks crashed. This event serves as a reminder of the risks associated with investing in growth stocks and the importance of diversifying one’s portfolio to mitigate these risks.

The Pros and Cons of Investing in Value Stocks

Photo Credits: Www.Mfea.Com by Gabriel Clark

Looking to dive into the world of stock market investing? Get ready to explore the pros and cons of investing in value stocks. Discover the advantages that value stocks bring to the table and uncover the potential risks involved. Whether you’re a seasoned financial enthusiast or just starting out, understanding the dynamics of value stocks is crucial for making informed investment decisions. So, let’s explore the exciting opportunities and potential pitfalls of this investment strategy!

Advantages of Value Stocks

- Lower Valuations: Value stocks offer the advantage of being priced lower than their intrinsic value, allowing investors to purchase them at a discount.

- Dividend Income: Value stocks have the advantage of being more likely to pay dividends, which provides investors with a steady income stream.

- Less Volatility: Value stocks possess the advantage of being generally more stable and less prone to significant price swings, making them an appealing choice for conservative investors.

- Contrarian Opportunities: Value stocks often go unnoticed or undervalued by the market, presenting advantageous opportunities for contrarian investors to discover hidden gems.

- Historical Performance: Value stocks have a solid advantage of historically outperforming growth stocks in the long term, offering the potential for attractive returns.

Legendary investor Warren Buffett is widely recognized for his value investing approach. By identifying undervalued companies with strong fundamentals, Buffett has consistently achieved remarkable success in the stock market, consequently solidifying the advantages of value stocks.

Risks Associated with Value Stocks

Investing in value stocks has its share of risks that investors need to be aware of. Risks associated with value stocks include market uncertainty, slow growth potential, potential value traps, management and turnaround risks, and industry and sector risks. Value stocks are often undervalued due to market uncertainties, making them vulnerable to market fluctuations and economic downturns. They are typically found in mature industries or companies that are experiencing slower growth compared to growth stocks, which limits their potential for significant capital appreciation. While some value stocks may appear cheap based on traditional valuation metrics, they may have fundamental issues or face long-term challenges that could lead to significant losses for investors. Moreover, investing in undervalued companies often involves betting on management’s ability to turn things around. If management fails to execute a successful turnaround strategy, investors could incur losses. Additionally, value stocks are often concentrated in specific industries or sectors, exposing investors to risks associated with those sectors, such as regulatory changes or technological disruptions.

Being aware of these risks and conducting thorough research is crucial when considering investments in value stocks. Diversification and a long-term investment horizon can help mitigate some of these risks.

Investing Strategies: Growth, Value, or Both?

Photo Credits: Www.Mfea.Com by Roy Rodriguez

Looking to navigate the world of investing? In this section, we’ll dive into the exciting realm of investing strategies: growth, value, or a combination of both. Get ready to discover the unique allure of each approach and gain insights into the potential benefits they offer. Whether you’re drawn to the growth-focused investment strategy, the value-focused investment strategy, or find yourself leaning towards a combination of both, we’ve got you covered. Let’s explore the fascinating world of investment strategies and find the approach that suits your financial goals.

Growth-focused Investment Strategy

A growth-focused investment strategy aims to capitalize on companies that are expected to experience rapid growth in their earnings and revenues. Here are some key points to consider when implementing this growth-focused investment strategy:

- Research and Analysis: Conduct thorough research to identify companies with strong growth prospects. Analyze their financial statements, industry trends, and competitive advantages.

- Invest in Innovative Industries: Focus on sectors that are experiencing rapid technological advancements and disruptive innovations, such as technology, healthcare, and renewable energy.

- Emphasize Revenue and Earnings Growth: Look for companies with a track record of consistently increasing their revenues and earnings over time. This indicates their ability to generate sustainable growth.

- Long-Term Horizon: Adopt a long-term perspective and be willing to hold onto your investments for an extended period. This allows you to benefit from the compounding effects of growth over time.

- Diversification: Spread your investments across multiple growth stocks to reduce the risks associated with investing in individual companies.

- Regular Monitoring: Continuously monitor the performance and prospects of your growth stocks. Stay informed about any changes in the company’s financials, industry dynamics, or competitive landscape.

Pro Tip: Remember that investing in growth stocks can be volatile, so it’s essential to have a strong risk management strategy in place. Consider setting stop-loss orders to protect your gains and limit potential losses.

Value-focused Investment Strategy

Value-focused Investment Strategy involves a deliberate search for undervalued stocks in the market. This investment strategy aims at identifying stocks that are trading below their intrinsic value, considering factors such as earnings, book value, and cash flow. Investors who adopt this strategy believe that these stocks have been overlooked by the market, creating an opportunity for potential growth. Generally, value investors seek stable companies with strong fundamentals and a consistent profit track record. By investing in undervalued stocks, they anticipate an increase in their value over time as the market eventually recognizes their true worth. Ultimately, a value-focused investment strategy can be a compelling approach for investors seeking bargains in the stock market. Growth vs. Value: The Eternal Debate Among Stock Market Enthusiasts

Combination of Growth and Value

Combining the growth and value investment strategies can provide a balanced approach to investing in the stock market. This combination allows investors to benefit from the potential future growth and undervalued assets.

By incorporating both growth stocks, which have a high potential for earnings growth, and value stocks, which are often undervalued and have the potential to increase in price, investors can diversify their portfolios and potentially achieve more stable returns over time. This approach enables investors to seize opportunities in both fast-growing and undervalued companies.

A compelling example that highlights the advantages of combining growth and value strategies is the story of Warren Buffett, one of the most successful investors in history. Buffett amassed his wealth by following a value investing strategy, investing in undervalued and out-of-favor companies. Additionally, he identified companies with growth potential and strategically acquired them, combining growth and value to maximize his returns.

Combining growth and value strategies empowers investors to build a well-rounded portfolio that offers the potential for both capital appreciation and stability. It is crucial to carefully analyze and select stocks that align with the desired combination of growth and value in order to achieve long-term investment goals.

Frequently Asked Questions

What is the growth vs. value debate in the stock market?

The growth vs. value debate in the stock market refers to the ongoing discussion among investors about whether growth stocks or value stocks offer better investment opportunities. Growth stocks are expected to outperform the overall market due to their potential for future growth, while value stocks are considered undervalued and offer a higher return.

What are the key differences between growth stocks and value stocks?

Growth stocks are typically associated with companies that have high earnings growth potential and trade at higher multiples, reflecting investors’ expectations of future profits. On the other hand, value stocks are often larger, well-established companies that trade below their perceived worth and are considered undervalued based on financial ratios such as price-to-earnings, book value, or cash flow ratios.

Why have value stocks historically performed better than growth stocks?

Studies have shown that value stocks have historically outperformed growth stocks in rolling 15-year periods. This dominance can be attributed to factors such as value stocks being viewed as bargains compared to their underlying worth and the dynamics of market cycles. However, it’s important to note that the performance drivers of each style are period-specific and are unlikely to be repeated consistently in the future.

What are the recent trends in the growth vs. value debate?

In recent years, growth stocks had a period of market leadership due to low interest rates and technological innovation. However, more recently, value stocks have seen a resurgence, fueled by fiscal and monetary stimulus, as well as positive vaccine headlines. The unique mix of factors driving the recent outperformance of value stocks may not be sustained beyond the near to medium term.

Which should I choose: growth stocks or value stocks?

The choice between growth stocks and value stocks depends on several factors, including an investor’s time horizon and risk tolerance. Growth stocks may be suitable for investors seeking higher potential returns and are willing to tolerate higher levels of risk. On the other hand, value stocks may appeal to investors looking for potentially undervalued opportunities and a more conservative investment approach. It’s important to carefully consider these factors and consult with a financial advisor before making investment decisions.

How does artificial intelligence (AI) impact the growth vs. value debate?

Artificial intelligence has the potential to reshape the growth vs. value debate by providing sophisticated analysis and insights into the underlying factors that drive the performance of different stocks. AI algorithms can analyze vast amounts of data and identify patterns that may not be easily discernible to human analysts. By incorporating AI into their investment strategies, investors may gain a deeper understanding of the value and growth potential of individual stocks, potentially aiding their decision-making process.