Balancing a portfolio by integrating growth stocks with stable dividends is a key strategy for achieving long-term financial success. By understanding the characteristics and benefits of both growth stocks and stable dividend stocks, investors can optimize their investment portfolio.

Starting with growth stocks, these are stocks of companies that are expected to experience substantial growth in their revenue and earnings. They often reinvest their earnings back into the business to fuel expansion and innovation. Investing in growth stocks can offer the potential for significant capital appreciation and higher returns over time. However, they also come with certain risks, such as higher volatility and the possibility of not meeting growth expectations.

On the other hand, stable dividend stocks are those that consistently distribute a portion of their earnings to shareholders in the form of dividends. These stocks typically belong to well-established companies with stable cash flows and a history of dividend payments. Investing in stable dividend stocks can provide a reliable income stream and act as a cushion during market downturns. However, they may have slower growth potential compared to growth stocks.

Finding the right balance between growth stocks and stable dividend stocks is crucial to strike a balance between risk and reward. A well-balanced portfolio can provide the potential for capital appreciation through growth stocks while ensuring stability and income from dividend stocks.

To achieve this balance, investors need to determine the right allocation between growth stocks and stable dividend stocks based on their financial goals, risk tolerance, and time horizon. Diversification across different sectors is also essential to mitigate risk and take advantage of various market opportunities. It is important to regularly monitor and rebalance the portfolio to maintain the desired balance between growth and stability.

Understanding Growth Stocks

Photo Credits: Www.Mfea.Com by Matthew Anderson

Understanding growth stocks is crucial for investors looking to construct a well-rounded portfolio. Growth stocks, which are shares of companies anticipated to experience significant increases in revenue and earnings, frequently reinvest their profits into research, development, and expanding their operations to fuel their growth. Investors are enticed by growth stocks due to their potential for substantial capital appreciation. It’s crucial to acknowledge that growth stocks also carry higher risks in comparison to more stable dividend-paying stocks. Having a clear comprehension of the dynamics and potential of growth stocks can empower investors to make informed decisions while diversifying their portfolio.

What are Growth Stocks?

What are Growth Stocks?

Growth stocks are shares of companies that have the potential to grow at a faster rate than the overall stock market. These companies typically reinvest their earnings back into the business instead of paying out dividends to shareholders. Growth stocks are known for their high potential for capital appreciation. Investors are attracted to growth stocks because they offer the opportunity for significant returns over time. They also come with risks, such as price volatility and a potential lack of dividends. It’s important for investors to carefully analyze the fundamentals of growth stocks before making investment decisions.

In a true history, Apple is a prime example of a growth stock. When the company introduced the iPhone in 2007, its stock price skyrocketed as the product gained popularity. Since then, Apple has continued to innovate and expand its product offerings, resulting in significant growth in sales and market value. As a result, investors who recognized the growth potential of Apple and invested in the stock early on have enjoyed substantial returns on their investment.

Advantages of Investing in Growth Stocks

- Growth stocks have the potential to deliver significant returns on investment due to their rapid earnings growth.

- As the company’s earnings grow, the value of the stock increases, providing investors with the opportunity for capital appreciation.

- Investing in growth stocks at an early stage allows investors to benefit from compounding returns over the long term.

- Growth stocks are often favored by investors seeking higher risk and higher reward opportunities.

- The excess cash generated by growth companies can be reinvested into the business, driving further growth and potentially increasing the value of the stock.

- Balancing a Portfolio: Integrating Growth Stocks with Stable Dividends

Risks Associated with Investing in Growth Stocks

Investing in growth stocks can offer significant returns, but it also carries certain risks. It’s important to be aware of these risks before making any investment decisions. Here are some key risks associated with investing in growth stocks:

- Volatility: Growth stocks can be highly volatile, experiencing sudden price fluctuations in response to market conditions.

- Limited Dividends: Unlike stable dividend stocks, growth stocks typically reinvest their profits into the company’s expansion, which means they may not pay dividends or offer limited dividend yields.

- Uncertainty: Growth stocks often operate in emerging or competitive industries, which can come with higher levels of uncertainty and risk.

- Valuation Risk: There is a risk of overvaluing growth stocks, as investors may bid up prices based on the company’s growth potential, leading to a potential bubble.

- Liquidity Risk: Some growth stocks may have lower trading volumes, making it difficult to sell shares quickly at a desired price.

- Business Risk: Investing in individual growth stocks exposes investors to the specific risks associated with that company, such as management decisions, competition, or regulatory changes.

Pro-tip: To mitigate the risks associated with investing in growth stocks, it’s advisable to diversify your portfolio by including other types of stocks, such as stable dividend stocks, and regularly monitor and adjust your investments based on market conditions.

Exploring Stable Dividend Stocks

Photo Credits: Www.Mfea.Com by Gregory Smith

Exploring stable dividend stocks is an essential task when it comes to balancing a portfolio. These stocks play a vital role in providing a steady income stream through regular dividend payments, which makes them highly advantageous for investors who seek stability. When analyzing these stocks, it is crucial to consider various factors, such as the company’s track record of consistent dividend payments, dividend yield, and payout ratio. Companies that have a track record of consistently increasing their dividends over time are particularly appealing. Some well-known examples of stable dividend stocks are Procter & Gamble, Johnson & Johnson, and Coca-Cola. These stocks not only ensure a reliable income stream but also possess the potential for long-term capital appreciation.

What are Stable Dividend Stocks?

Stable dividend stocks are companies that consistently distribute a portion of their profits to shareholders in the form of dividends. These stocks are typically associated with more established companies that generate reliable cash flows and have a history of paying dividends. Investors often seek stable dividend stocks as they provide a steady income stream and can offer a degree of stability to a portfolio. Examples of stable dividend stocks include well-known companies like Coca-Cola and Johnson & Johnson. Investing in stable dividend stocks can be attractive for those looking for regular income and a lower level of risk in their investment strategy. So, what are stable dividend stocks? They are companies that provide a reliable source of dividends to shareholders and can offer a sense of security in a investment portfolio.

Benefits of Investing in Stable Dividend Stocks

Benefits of Investing in Stable Dividend Stocks

Investors seeking consistent income and long-term stability in their portfolios can benefit from investing in stable dividend stocks. These stocks offer several key advantages to consider:

- Regular Income: Stable dividend stocks provide a steady stream of income through regular dividend payments.

- Dividend Growth: Many stable dividend stocks have a track record of increasing their dividend payouts over time, allowing investors to benefit from compounding returns.

- Inflation Hedge: Dividend payments can help protect against the eroding effects of inflation, as dividend increases often outpace inflation rates.

- Portfolio Stability: Stable dividend stocks are generally associated with less volatility compared to growth stocks, providing investors with a more stable investment option.

- Total Return Potential: In addition to regular dividends, stable dividend stocks have the potential for capital appreciation over the long term, offering investors a combination of income and growth.

- Historical Performance: Historical data suggests that stable dividend stocks tend to outperform non-dividend-paying stocks and even some growth stocks over the long run.

- Income Throughout Market Cycles: Stable dividend stocks can provide a reliable income stream even during challenging market conditions, making them attractive for income-focused investors.

By incorporating stable dividend stocks into a balanced portfolio, investors can benefit from consistent income, potential capital appreciation, and long-term stability.

Potential Drawbacks of Investing in Stable Dividend Stocks

Here are some potential drawbacks of investing in stable dividend stocks. It is important to consider these factors along with the benefits they offer:

| Lower growth potential: | Stable dividend stocks are known for their consistent payouts, but they may have limited prospects for significant capital appreciation. |

|---|---|

| Interest rate sensitivity: | Dividend stocks can be sensitive to changes in interest rates. When interest rates rise, dividend yields may become less attractive, impacting the stock’s performance. |

| Market value volatility: | While stable dividend stocks generally provide a degree of stability, they can still experience fluctuations in market value, especially during economic downturns. |

| Industry risk: | Some industries, such as utilities or consumer staples, are more prone to regulatory changes or market shifts, which could impact the stability of dividend payments. |

To mitigate these potential drawbacks, consider diversifying your portfolio with a mix of growth stocks and stable dividend stocks. It is advisable to consult with a financial advisor to determine the right balance based on your financial goals and risk tolerance.

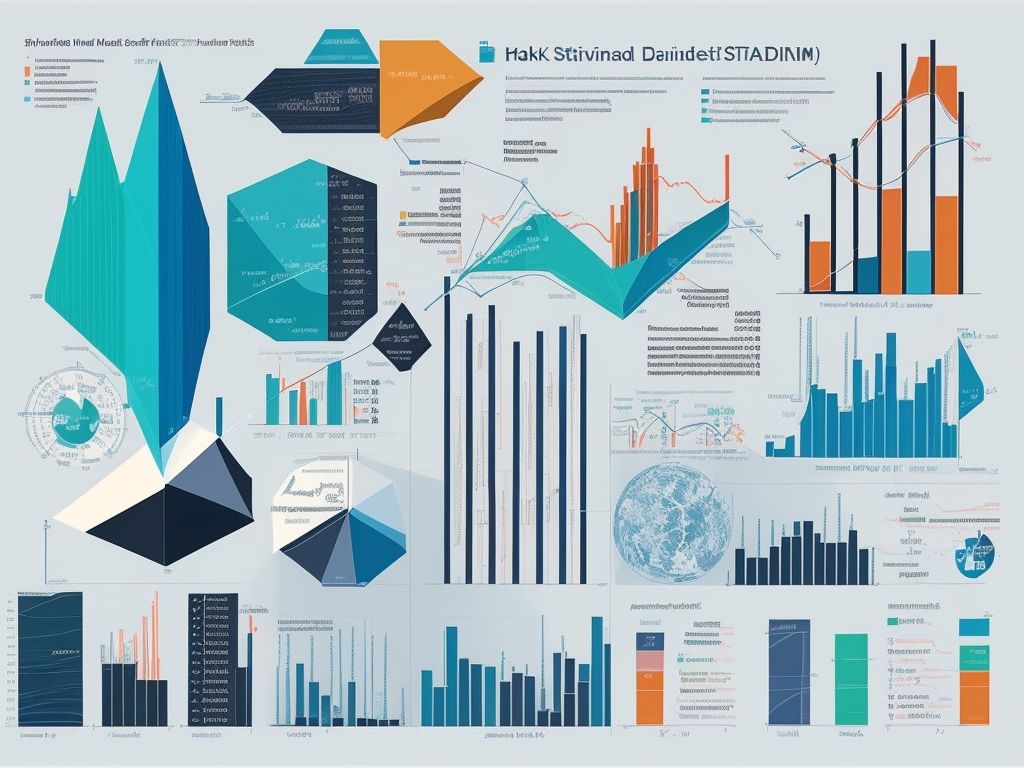

The Importance of Balancing Growth and Stability

Photo Credits: Www.Mfea.Com by Keith Lopez

The Importance of Balancing Growth and Stability in Building a Portfolio

Balancing growth and stability is of utmost importance when constructing a portfolio. This approach plays a key role in mitigating risks and achieving consistent returns. While growth stocks offer the potential for high returns, they also come with a higher level of volatility. On the other hand, stable dividend stocks provide a steady income stream that is less affected by market fluctuations. By combining these two types of investments, investors can benefit from both capital appreciation and regular income.

Maintaining a well-balanced portfolio also acts as a shield against market downturns and provides stability during uncertain times. It is crucial to carefully evaluate individual risk tolerance, investment goals, and time horizon in order to determine the ideal balance between growth and stability.

Why is Balancing a Portfolio Necessary?

Why is balancing a portfolio necessary? Balancing a portfolio is necessary because it helps manage risk and maximize returns. It allows you to diversify your investments and hedge against market fluctuations. By investing in a mix of growth stocks and stable dividend stocks, you can potentially achieve both capital appreciation and regular income. Growth stocks offer high growth potential but can be volatile, while stable dividend stocks provide consistent income but may have slower growth. Finding the right balance between the two types of stocks allows you to create a well-rounded portfolio that meets your financial goals. It is important to regularly review and rebalance your portfolio to ensure it aligns with your changing investment objectives and market conditions.

How to Determine the Right Balance between Growth Stocks and Stable Dividend Stocks

- Assess Investment Goals: To determine the right balance between growth stocks and stable dividend stocks, it is crucial to assess your financial objectives, risk tolerance, and investment timeline.

- Understand Risk-Return Tradeoff: Evaluating the potential gains and losses associated with both growth stocks and stable dividend stocks helps in determining the optimal balance.

- Analyze Market Conditions: Study market trends, economic indicators, and sector performance to identify potential opportunities and risks, which aids in finding the right balance.

- Diversify Portfolio: Allocate a portion of your portfolio to both growth stocks and stable dividend stocks to mitigate risk and capture growth, ensuring a well-rounded portfolio.

- Consider Individual Stocks: Before making investment decisions, it is important to examine the fundamentals, financial health, and growth prospects of individual companies.

- Rebalance Regularly: Periodically review and adjust your portfolio to maintain the desired balance as market conditions and investment goals change, achieving the right balance.

During the financial crisis of 2008, many investors who had an imbalanced portfolio heavily weighted towards growth stocks suffered significant losses. However, those with a balanced mix of growth and stable dividend stocks experienced more stability and were able to recover faster. This clearly emphasizes the importance of determining the right balance between growth stocks and stable dividend stocks to protect and grow your investments.

Strategies for Integrating Growth Stocks with Stable Dividends

Photo Credits: Www.Mfea.Com by Willie Wilson

Looking to optimize your portfolio? Discover the art of integrating growth stocks with stable dividends! In this section, we’ll dive into powerful strategies that can supercharge your investment game. From allocating your portfolio percentage wisely to diversifying across various sectors, we’ll cover it all. Get ready to explore risk-adjusted returns and unleash the potential for impressive financial growth. It’s time to align your investments and watch your portfolio flourish with a winning combination of growth and stability.

Allocating Portfolio Percentage

Allocating the portfolio percentage is a crucial step in balancing a portfolio that integrates growth stocks with stable dividends. It involves carefully distributing your investments across different asset classes to achieve the desired risk and return profile.

- Evaluate your risk tolerance and investment goals.

- Determine the percentage of your portfolio that you want to allocate to growth stocks and stable dividend stocks.

- Consider your time horizon and investment horizon. Short-term goals may require a higher allocation to stable dividend stocks, while long-term goals may allow for a larger allocation to growth stocks.

- Research and select specific growth stocks and stable dividend stocks that align with your investment strategy.

- Continuously monitor and evaluate the performance of your investments and make adjustments as necessary.

Fact: According to a study by Vanguard, asset allocation is responsible for 88% of the variability in a portfolio’s returns.

Diversifying Across Different Sectors

- Diversify across various sectors to effectively balance your portfolio and spread risk.

- Research and identify sectors with growth potential to align with your investment goals.

- Consider selecting stocks from different sectors to ensure diversification.

- Enhance your diversification strategy by investing in ETFs or mutual funds that provide exposure to a wide range of sectors.

- Monitor your portfolio regularly and make adjustments based on market trends and sector performance.

- Maintain a balance between growth stocks and stable dividend stocks to mitigate risk.

By diversifying across different sectors, you can increase the chances of achieving a well-rounded and resilient portfolio.

Evaluating Risk-Adjusted Returns

Evaluating risk-adjusted returns is essential when constructing an investment portfolio. It is crucial for investors to assess the performance of their investments while considering the level of risk taken. One effective method to assess risk-adjusted returns is by employing the Sharpe ratio. This ratio measures the excess return generated by an investment in comparison to its volatility. To achieve better risk-adjusted returns, investors should aim for a higher Sharpe ratio. Diversification across various asset classes can aid in managing risk and maximizing returns. Consistently monitoring and rebalancing the portfolio ensures that it remains aligned with the investor’s risk tolerance and investment objectives. Pro-tip: It is advisable to seek professional financial advice to obtain a comprehensive evaluation of risk-adjusted returns.

Regular Monitoring and Rebalancing

Photo Credits: Www.Mfea.Com by Roy Lee

Regular monitoring and rebalancing are essential in maintaining a well-balanced investment portfolio. Follow these steps:

- Establish a regular schedule, such as quarterly or annually, for reviewing your portfolio.

- During the review, evaluate the performance of each investment and compare it to your desired asset allocation.

- If an investment has significantly deviated from your target allocation, take action by either selling or purchasing additional shares to restore balance.

- Consider the overall market conditions and adjust your portfolio strategy accordingly, taking into account your risk tolerance and investment goals.

- Continuously perform this process to ensure that your portfolio remains aligned with your objectives.

Fact: Research has consistently shown that investors who regularly monitor and rebalance their portfolios tend to achieve superior long-term performance compared to those who neglect this crucial task.

Frequently Asked Questions

1. What are the main risks that investors face when building a dividend portfolio?

Investors building a dividend portfolio face the risks of market turmoil and company-specific risks. Market turmoil refers to unpredictable fluctuations in the overall stock market, while company-specific risks are risks that are specific to individual companies. It is important for investors to balance these risks when building their portfolio.

2. How can a dividend portfolio provide a steady annual income stream?

A dividend portfolio can provide a steady annual income stream through regular dividends paid by the companies in the portfolio. Dividends are a share of profits that companies distribute to their shareholders. By investing in dividend-paying stocks, investors can receive regular payments, which can be particularly attractive for income investors.

3. What factors should be considered when balancing a portfolio of growth stocks with stable dividends?

When balancing a portfolio of growth stocks with stable dividends, factors such as the company’s dividend safety scores™, market risk, and the global economy’s growth outlook should be considered. It is important to find the right mix of stocks that align with investment objectives and risk preferences.

4. How can diversification help reduce the risk of a dividend portfolio?

Diversification refers to including a variety of stocks from different industries in a portfolio. By diversifying across multiple companies, investors can reduce their dependence on any single stock and better weather unexpected events. A diversified portfolio is less likely to experience a permanent loss of capital as long as the overall market continues to advance.

5. What are some tried and true investing tactics for building a successful dividend portfolio?

Some tried and true investing tactics for building a successful dividend portfolio include doing thorough research on potential companies, targeting companies with safe or very safe dividend safety scores™, and not investing excessive risk in any one sector. It is also important to have a long-term time horizon and to be patient and wait for the right price before making investment decisions.

6. Why is it important to consider both growth stocks and stable dividends in a portfolio?

Considering both growth stocks and stable dividends in a portfolio is important for creating a well-rounded investment strategy. Growth stocks have the potential for higher investment returns, while stable dividends provide a regular income stream. By combining these two types of stocks, investors can benefit from both potential capital appreciation and consistent income generation.