Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

A gold IRA can be a great choice to enhance your financial portfolio's security. Rosland Capital is a reputable company that provides guidance and assistance to clients interested in investing in precious metals.

Their expertise extends to offering valuable insights on maximizing investment returns and navigating the complexities of the market.

Rosland Capital is committed to transparency and integrity, evident in its "No Gimmicks" approach. This ensures clients can trust the company to provide reliable and straightforward information throughout their online presence.

One of the standout features of Rosland Capital is the user-friendly platform that allows clients to easily view and manage their portfolios and execute trades when needed.

To further enhance its services, Rosland Capital has enlisted the expertise of renowned economist Jeffrey Nichols. Nichols works closely with the firm and its clients, providing valuable insights and contributing to the official newsletter.

This collaboration ensures that clients receive expert advice and stay informed about the latest developments in the precious metals market.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

Background and History of Rosland Capital

Rosland Capital was established in 2008 by Marin Aleksov, a seasoned professional with over 20 years of experience in the industry. Headquartered in Los Angeles, the company has expanded its reach globally, serving clients worldwide.

They have established foreign bureaux in key locations such as London, Hong Kong, Munich and Stockholm, further solidifying their international presence.

While Rosland Capital specializes in the precious metals market, they differentiate themselves by investing in the paper commodity market. This diversification allows them to offer a broader range of investment options compared to some of their competitors.

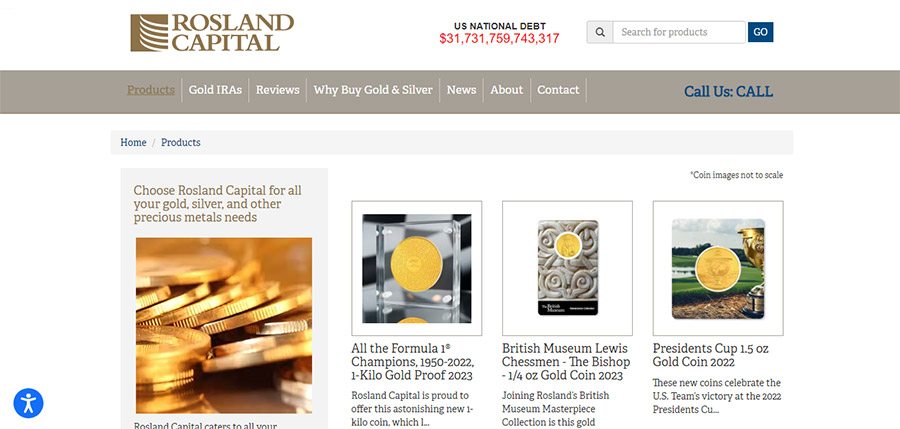

In addition to their IRA services, Rosland Capital offers an extensive selection of products beyond precious metals that can be included in a retirement account.

One notable aspect of Rosland Capital is their exclusive partnership, which makes them the sole retailer offering PGA Touring and racing coins, rare numismatics and other exclusive niche items.

This unique selection sets them apart from other companies in the industry and provides customers with access to collectibles that are not widely available.

Rosland Capital strongly emphasizes superior customer service and aims to educate and inspire trust in its clients' investment decisions.

They are committed to empowering their customers with knowledge and expertise, making them more informed consumers of gold and other precious metals for their Rosland Capital IRA.

Is Rosland Capital a Legit Company?

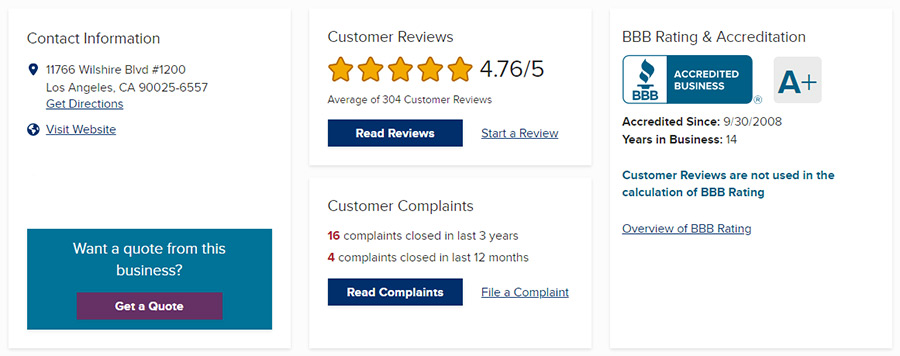

Rosland Capital is a legitimate business with a solid reputation in the industry. One way to assess the company's standing is by looking at its profile on the Better Business Bureau (BBB) website. With an A+ grade and an average rating of 4.69 stars across 285 user reviews, Rosland Capital has received recognition from the BBB.

While reviews from different sources present a variety of suggestions, it is important to note that most customers are satisfied with their experience. TrustLink, for example, has 70 reviews with an average rating of 3.7 stars.

While there are some complaints, overall, customers express their satisfaction. Trustpilot has a lower average rating of 2.9 stars, but it is based on a smaller sample size of only six reviews.

It's worth mentioning that Rosland Capital has received some critical feedback and customer complaints. Over three years, the BBB recorded 30 complaints against the company, with 12 of them being resolved in the past year. Most of these complaints revolve around issues related to the sale, return and shipment of precious metals.

Despite these complaints, Rosland Capital maintains an A+ rating with the BBB and a AAA rating with the Business Consumer Alliance. TrustLink, with 19 complaints, has given the company a rating of 4 out of 5 stars.

While it is important to consider customer complaints and issues, it is also crucial to note that the number of complaints is relatively trivial compared to the total number of positive reviews and satisfied customers.

By examining the company's approach to addressing these concerns and any discernible trends in their resolution, one can better understand Rosland Capital's commitment to customer satisfaction.

Products and Services

Rosland Capital offers a variety of products and services to cater to the diverse investment needs of its clients. They provide expertise and guidance on purchasing precious metals such as gold and silver bars, coins and other forms of bullion.

Whether clients are new to investing in precious metals or experienced investors, Rosland Capital can assist them in making wise decisions about their investments.

In addition to its product offerings, Rosland Capital provides comprehensive services to assist clients in managing their portfolios effectively. They offer advice on portfolio management, tax-loss harvesting and risk management strategies, enabling clients to optimize their investment returns and minimize potential risks.

With its expertise in the field, Rosland Capital aims to empower clients to make well-informed investment decisions.

Rosland Capital goes beyond traditional investment services by offering various financial planning services. They assist in retirement planning, tax planning, estate planning and personal finance and investing education.

Clients can benefit from financial seminars, workshops and webinars designed to educate and empower individuals on various investing and financial planning aspects.

The company also takes pride in its team of highly skilled financial advisors who provide personalized advice and guidance to clients. These advisors specialize in understanding clients' investment objectives, risk tolerance and financial goals.

By leveraging its expertise, Rosland Capital helps clients develop customized investment portfolios that align with their needs and preferences.

One of Rosland Capital's popular offerings is its gold IRA education and assistance services. They provide valuable information and support to clients interested in setting up self-directed IRAs backed by precious metals.

Clients appreciate the company's personnel for their willingness to go the extra mile in explaining complex concepts clearly and understandably.

Rosland Capital's product offerings include various investment options, such as silver and gold coins, gold bars, numismatic collectibles and historic coins. They also specialize in providing self-directed IRAs that allow individuals to include precious metals in their retirement savings strategy.

Pricing and Storage Options

Rosland Capital maintains its pricing structure transparently, ensuring no hidden or additional service charges. According to reviews from various sources, the company clearly states and discloses all expenses to its customers. The fees associated with the process are openly communicated to those interested in setting up a gold IRA.

When establishing a gold IRA with Rosland Capital, there is a $50 startup cost and an annual administration charge of $225.

It's worth noting that additional storage fees may apply and it is recommended to discuss these details with a designated representative from the company. Furthermore, a minimum investment of $10,000 is required to initiate the gold IRA.

Regarding storage options, individuals can choose where they store their gold. This can include keeping it in a bank, at home or any other secure location that aligns with their preferences and needs.

However, it is important to note that Rosland Capital does not offer segregated storage services like some other companies. Instead, when opening a gold IRA with Rosland Capital, the gold will be stored at a facility other gold IRA holders utilize.

Customer Complaints

Rosland Capital has faced several customer complaints, highlighting specific issues that have caused dissatisfaction. One prominent complaint revolves around the delivery service provided by the company.

Numerous customers have reported experiencing delays beyond the promised 14-day delivery period, which can negatively impact the timely inclusion of their investments in their portfolios.

Overvalued Coins

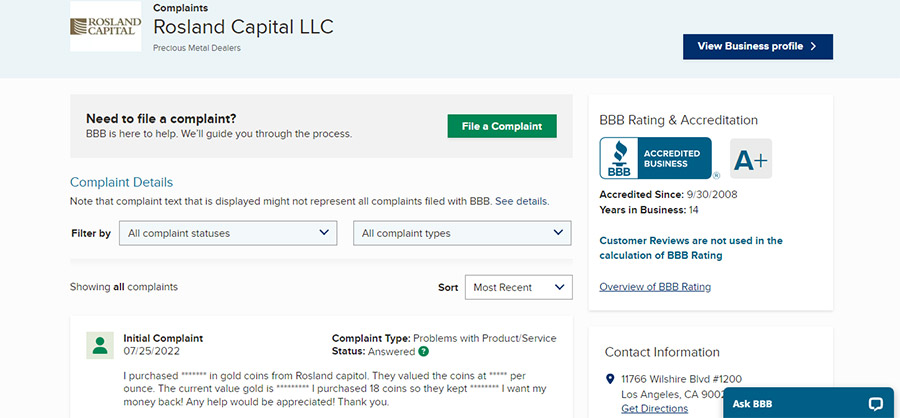

One notable complaint centers on the matter of overvalued coins. In a particular incident in August 2022, a customer expressed disappointment with purchasing gold coins. They claimed to have spent a substantial amount on coins expected to hold a certain value per troy ounce.

However, upon receiving the coins, they discovered that the actual value of the gold fell short of their expectations.

Having acquired 18 coins, the customer felt they had incurred significant financial losses and demanded a full reimbursement. Rosland Capital responded promptly, explaining the distinction between buy and spot pricing and the industry-standard markups applied to precious metals.

The company representative mentioned that the customer intended to investigate the matter further. However, the customer remained dissatisfied with the response, contending that they had spent $50,400 on the transaction but had received coins valued at only $30,000.

While asserting they had done nothing wrong in the encounter, Rosland Capital acknowledged the customer's feedback and offered a higher repurchase price. While under no obligation to do so, the company made this gesture as the standard buyback price was lower.

Nevertheless, the customer insisted on a complete refund and retained the coins. They were advised to contact their designated agent if they ever decided to utilize the repurchase program to ensure favorable terms.

Frustrations with Rosland Capital's Buyback Program

Customers who purchase gold from the company are given the option to resell their gold at a later date. However, in July 2022, a customer expressed dissatisfaction with the buyback policy, claiming that all communication ceased when they attempted to sell their coins.

Despite multiple attempts to contact Rosland Capital via phone, email and messages, the customer has yet to receive a response.

In response, Rosland Capital stated that they had contacted the customer and provided instructions on selling the coins. The customer was given time to consider the offered price before deciding whether to proceed.

However, the customer expressed frustration, alleging that Rosland Capital had contacted them during work hours and had refused to email the offer. They also described the representative as unprofessional and unpleasant, suggesting that the company should be further scrutinized.

Rosland Capital responded by asserting they failed to communicate with the customer. They clarified that the representative was responsible for providing a purchase order detailing the coins and their corresponding repurchase prices. If the customer disagreed with the offered price, they had no obligation to complete the transaction.

Additionally, Rosland Capital referenced the buyback clause from the buyer agreement signed in 2015, outlining the specific procedures and timeframes for buyback transactions.

The dissatisfied customer declared their decision to discontinue any further dealings with Rosland Capital and preferred only verbally approving contracts after careful review. They mentioned reaching out to a more trustworthy business, as they believed Rosland Capital had sold them coins of subpar quality.

Rosland Capital has yet to respond and the customer and the company are no longer engaged in any business relationship. Despite the customer's discontent, Rosland Capital maintained that they followed the appropriate procedures outlined in the buyback paperwork.

Precious Metals IRAs and Why You Should Invest in Them

A precious metals IRA offers several compelling benefits that make it an attractive investment choice for individuals planning for retirement.

Hedge Against Inflation and Market Volatility

Precious metals, particularly gold and silver, have a long history of retaining their value during economic uncertainty. They are often considered haven investments that can hedge against inflation and protect against the erosion of purchasing power.

Adding precious metals to your retirement portfolio can help mitigate the risks associated with market volatility and economic downturns.

Diversification and Portfolio Protection

Investing in precious metals can benefit diversification by adding an asset class with a low correlation to traditional stocks and bonds. This diversification helps reduce the overall risk in your portfolio and can enhance its resilience during turbulent market conditions.

Precious metals have historically shown an inverse relationship to the performance of other asset classes, which means that when stocks and bonds decline, precious metals tend to rise, providing a valuable buffer.

Potential Tax Advantages

Rolling over existing retirement accounts, such as a 401(k) or traditional IRA, into a precious metals IRA can offer potential tax benefits. By using a self-directed IRA to hold precious physical metals, investors can defer taxes on any gains until they start taking distributions in retirement.

Additionally, some types of precious metals IRAs, such as a Roth IRA, can provide tax-free growth and withdrawals, offering even greater tax advantages.

Cost Efficiency and Control

Investing in a precious metals IRA allows you to purchase and sell precious metals without incurring additional costs from brokers or commissions. This can lead to significant cost savings compared to other investment vehicles.

Moreover, holding the physical metals in your IRA gives you direct control over your investment and you can easily monitor its performance.

Liquidity and Accessibility

Precious metals are highly liquid assets easily be converted into cash. This can benefit retirees who require quick access to funds during their retirement years. The ability to swiftly sell your precious metals holdings and convert them into cash provides financial flexibility and security.

Preservation of Wealth

Precious metals have stood the test of time as a store of value. They have been used for centuries for exchange and wealth preservation. Unlike paper currencies, which can be subject to inflation and devaluation, precious metals have inherent value and can help protect your wealth over the long term.

Tangible and Physical Assets

One of the unique aspects of investing in precious metals is owning tangible and physical assets. Unlike stocks or bonds in digital form, you can hold gold coins, silver bars or other precious metal products in your hands.

Knowing that your investments have a physical presence, this tangibility can provide security and peace of mind.

Potential for Capital Appreciation

While the primary purpose of a precious metals IRA is wealth preservation, there is also the potential for capital appreciation. The value of precious metals can fluctuate over time and if their prices increase, your investment can grow.

This potential for capital appreciation can enhance your overall investment returns and contribute to the growth of your retirement savings.

Portfolio Rebalancing and Risk Management

Precious metals can be valuable for portfolio rebalancing and risk management. When other asset classes, such as stocks or bonds, become overvalued or exhibit increased volatility, reallocating your portfolio to precious metals can help rebalance risk and maintain a diversified investment strategy.

Precious metals act as a counterweight to traditional investments, providing stability during market downturns.

Legacy and Inheritance Planning

Precious metals can play a role in legacy and inheritance planning. Unlike digital assets or investment accounts that may be subject to legal and bureaucratic hurdles, physical precious metals can be easily passed down to future generations.

They can serve as a tangible asset with monetary and sentimental value, preserving wealth and providing a lasting legacy for your loved ones.

Opening a Gold IRA with Rosland Capital

To establish a gold IRA with Rosland Capital, follow these steps:

Final Thoughts

When considering precious metals and IRA investments, it is crucial to evaluate Rosland Capital and its competitors thoroughly. While Rosland Capital offers investment opportunities in precious metals and IRAs, there are certain drawbacks to consider before deciding.

One significant concern is the numerous complaints regarding Rosland Capital's customer service. Poor customer service can deter investors who value a responsive and reliable support system.

When selecting a firm for gold and IRA services, it is essential to prioritize companies with a proven track record and exemplary customer service. While Rosland Capital may have some positive qualities, other firms may provide a more comprehensive range of services and superior customer support.

In addition to considering a firm's reputation, it is also advisable to examine reviews and customer complaints. In Rosland Capital's case, many negative reviews and customer complaints exist. This should raise caution and prompt careful consideration when making a decision.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<